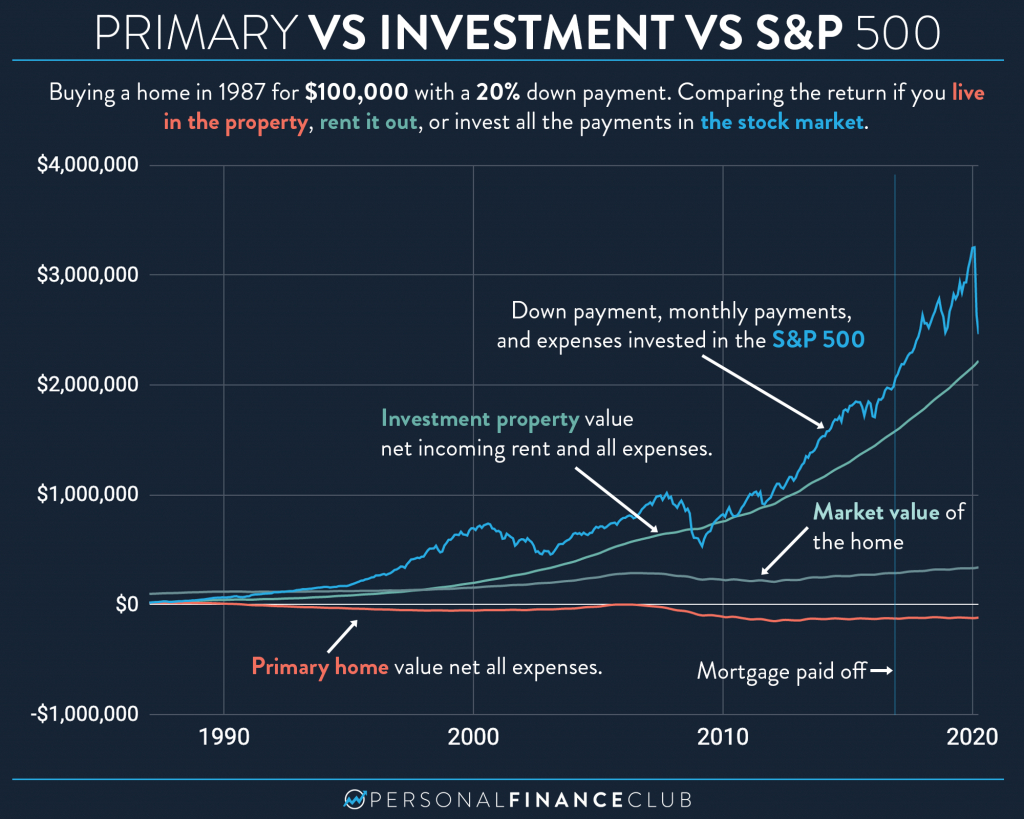

I often discuss how owning your primary home isn’t a great investment. In fact, after you account for property taxes, mortgage interest, maintenance, insurance, and realtor fees, almost every homeowner loses money net of their expenses. While most homeowners do sell the property for more than they bought it for, that just gives the illusion of a profit on closing day. In reality, they’re just getting back some of the money they put into it. They’re still losing money overall on the transaction. (Yeah, I know. Renting isn’t free either. Wherever you live is an expense, rent or own).

I’m afraid when I talk about this, people conflate “the home you live in” with “investment real estate”. But they couldn’t be more different, as far as investment returns go. Because investment real estate has one gigantic difference: There’s income.

So here’s a look at the exact same contributions, to the exact same house. In one scenario you live in it, and in one scenario you rent it out. You can see the results are dramatically different. Over this timeframe, for every $1,000 you put into your primary home, you get back about $714. Whereas for the investment property, every $1,000 you put into it, you get back $5,610.

I also threw in the S&P 500 to see how an investment property stacks up. They’re pretty close! (Although, managing a property for 33 years is a lot more work than leaving money in an index fund.) And while the stock market is efficient, and the only thing you can reliably do to increase your returns is minimize fees, the real estate market is certainly not efficient. Savvy real estate investors can get dramatically better returns than poor investors. The return modeled here is my attempt at an average return on a single property over this time frame. I made all sorts of assumptions. You can see the numbers and even tweak them yourself on this Google sheet. (Just do File/Make a Copy…) as mine isn’t directly editable.

And of course, you can’t live in an investment property or in the S&P 500. But when deciding how much to spend on your primary residence, consider minimizing that cost and redirecting the difference into a great investment, like an index fund or an investment property!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

September Sale!

September Sale!