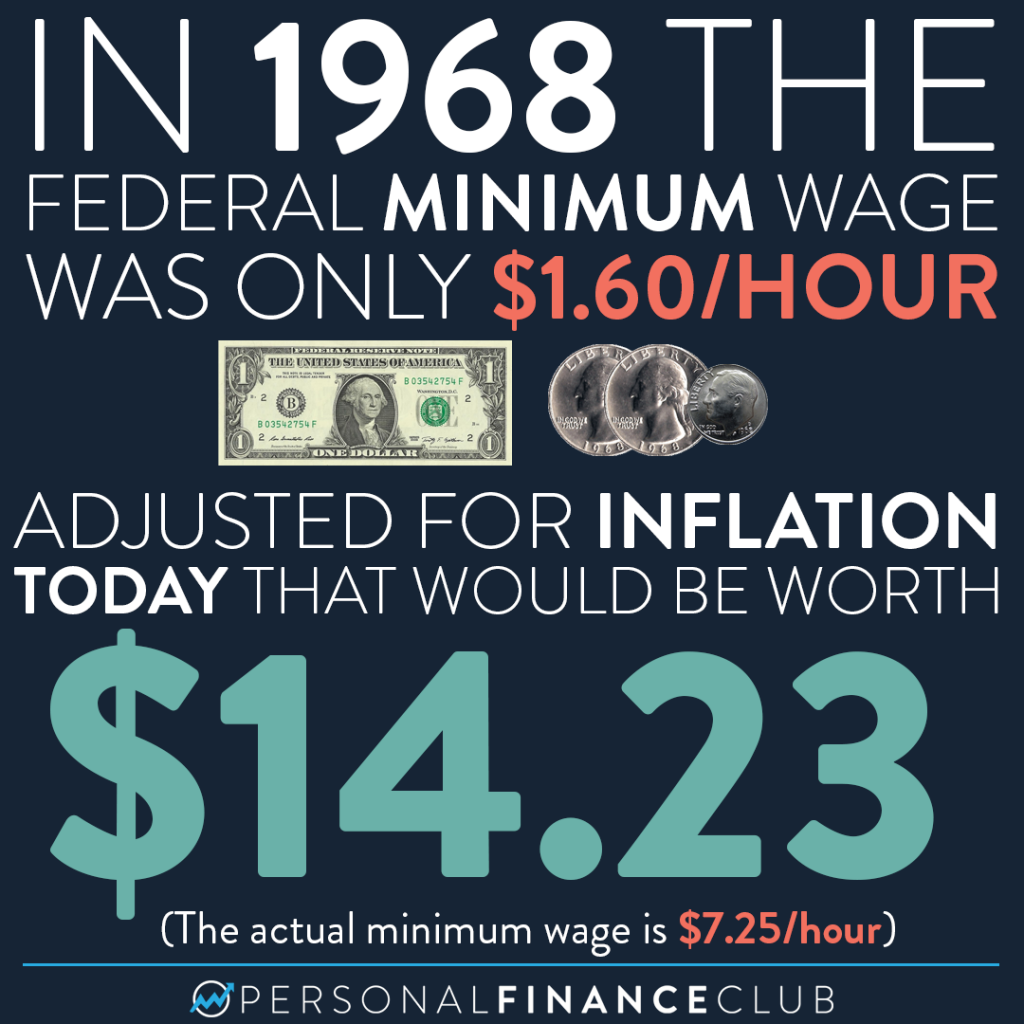

I was working on another post, calculating how much money you need to have invested to be equivalent to working minimum wage for a year (About $148K) and it struck me how devastatingly small the minimum wage is. At $7.25/hour if you work 40 hours/week for 52 weeks a year, taking zero vacation days you make about $15,000/year before taxes. That’s about $1,250/month. That’s barely enough to cover rent for an average one bedroom apartment, not to mention other things you need to live, like food, clothes, utilities, transportation, etc, making it basically impossible to survive.

Some have called for a $15 minimum wage. Others have called that proposal radical. Not only is it it not, “radical”, it’s barely keeping us on par with where were at in 1968 after accounting for inflation. And the economy survived the 70s and 80s after this change! (The S&P 500 actually averaged 11.3% annualized during those two decades).

If you’re making minimum wage, no amount of frugality is going to solve your financial situation. You need to increase your income. I think the best way to do that is to adopt a long term mentality. Imagine your dream situation five years in the future. If that were to come true, what would you have to be doing today to make that happen. A different job? A degree? Starting a business? Whatever it is, it won’t happen on its own. It starts with your decision to take small, incremental steps towards that goal. It helps to break down those steps into tiny bite size pieces. If one of your steps is “get a Master’s degree”, break it down to smaller things. Maybe the first step is “look up a local university that offers a Master’s programs.” or “Ask Jill about her experience getting a Master’s”. Those are things you can do in less than an hour that will push you to the next small step on your journey.

Don’t wait 5 years and still be right where you are!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!