As a human, it’s totally ok to have money regrets. Rather than dwell on the past, what areas of your current financial life will your future self look back on and wish that you had changed? The decisions you make today will help limit any future regrets!

We got most of the items on this list by asking members in the PFC Facebook Group. (If you are not already part of the group, what are you waiting for!). The most common answer by far was some variation of wishing they started saving and investing earlier.

Remember, to focus on what is in your control. Nothing in the past can be changed. But what you choose to do today will change the course of your future. Yes, it would have been great if we all started investing a long time ago. BUT, at some point in the future, right now will be “a long time ago” and we will be grateful that we took our finances seriously today!

Whether it’s opening up your first investment account or starting to do a backdoor Roth IRA, write down what you want to do on your to do list. Then carve out the time to make it happen. By doing the things you normally would keep putting off, your future self will look back proudly!

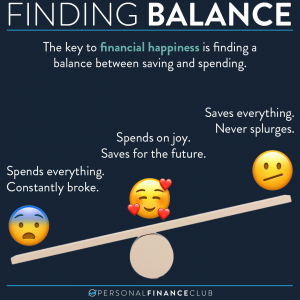

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!