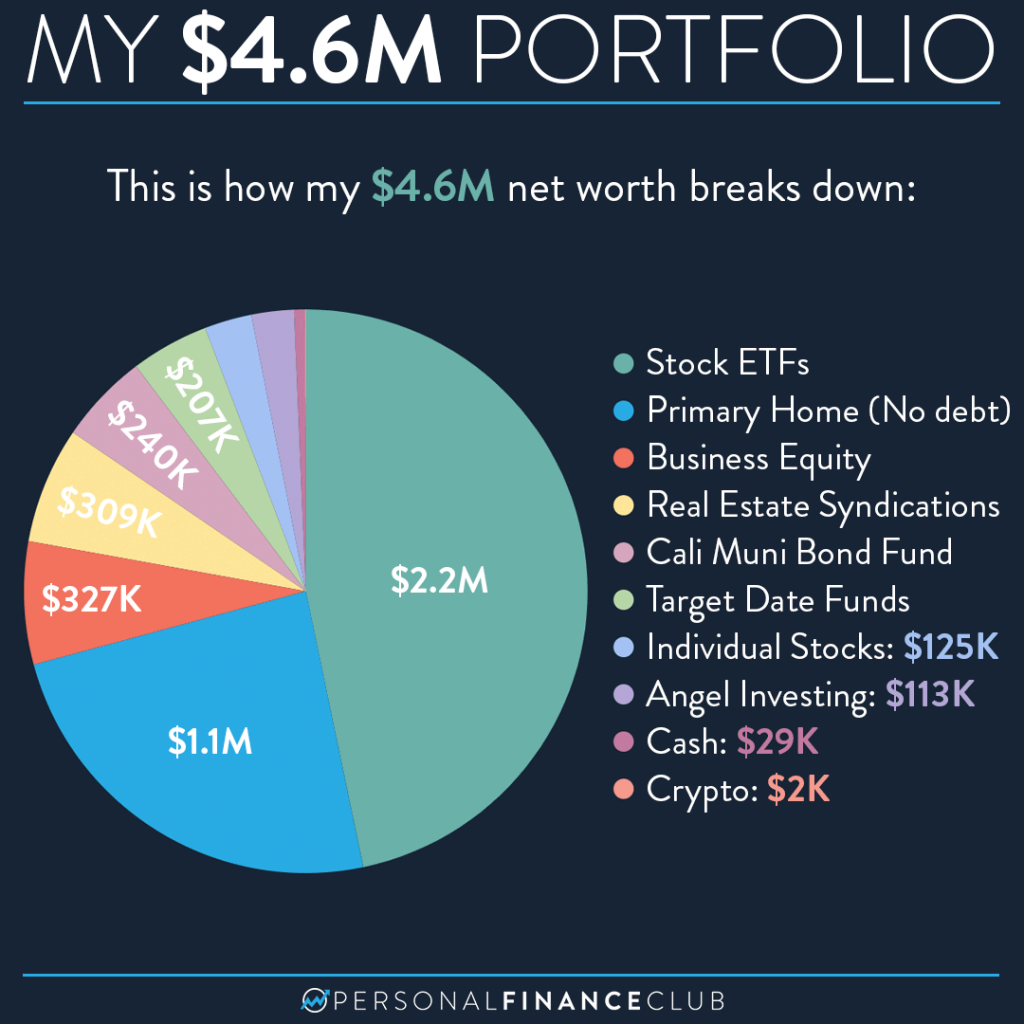

I post stuff like this in the name of transparency. I think it can be helpful to see what others are doing as a reality check on your own financial strategy. However, this isn’t meant to be a blueprint for an optimal portfolio. In fact, it’s not what I would do if I was starting over!

Namely, most of my money is split between different ETFs that cover large cap, small cap, international, emerging markets, and real estate. I could have made that much more simple by buying a SINGLE target date index fund. In fact, that’s how I’m investing new money. I could SELL those 5 ETFs and dump that all into a target date index fund. That wouldn’t be crazy, but I don’t for a couple reasons. One, since most of that money is in a taxable brokerage account, and I have large unrealized gains, selling those ETFs at a large gain would incur a tax bill. All things equal, I’d prefer to delay that tax bill as much as possible. The other reason I don’t do it is I believe in “staying the course”. I set up those ETFs for a reason, and those reasons are still valid. Just because I have a SLIGHT preference for a different way, I defer to “staying the course” as I think too much changing of direction is more likely to hurt me than help me.

The California Municipal Bond Fund and Real Estate Syndications are also kinda “meh” for me. There’s logic behind them. The California Bond fund has decent returns for bonds and isn’t federally taxed. Since it’s in a taxable account the “taxable equivalent growth” starts creeping toward historical stock fund returns, hopefully with less volatility. Real estate syndications are when you give someone a bunch of money to buy a tiny percent of some big real estate deal. For example, I own a fraction of a percent of some apartment community in Austin, TX I’ve never visited. That’s attractive for the reasons real estate investing is, with hopefully less work.

THAT SAID, if I had dumped every penny into a target date index fund, I’d probably be about as well off (or possibly more so) and my life would be way simpler.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!