Before you say “oh must be nice, you fat cat, millionaire, no-eye-browed turd”, let’s back up a few years. (And I DO have eyebrows, they’re just very light) BEFORE I was a millionaire I DID have debt payments. I went into about $12,000 of credit card debt in my early-twenties, and I borrowed about $10K to buy a used car in my mid-twenties. I did it because it was NORMAL. A car payment, a credit card payment. Everyone does it. Why not me.

But I didn’t like it. I hated writing that check every month for purchases I had made years earlier. It felt so backwards and counter productive. Even though I was only making $36K/year, I decided to change! I paid off my credit card debt, and sold the car I bought for $10K for $6K. Then I took that $6K and bought a $3K car, and saved/invested the other $3K. I drove that $3K car for 6 years. Once every year or so, I had to do some maintenance on it that averaged about $500. But $500 once/year is about $42/month. The average car payment is over $700/month. OUCH.

So making $36K/year I was already living that debt-free life. That enabled me to live comfortably, albeit frugally, and even save/invest some money every month. I was well on my way to millionaire status just from my savings and investments on a $36K salary. That’s something that wouldn’t have been possible if I racked up some of these debts shown here.

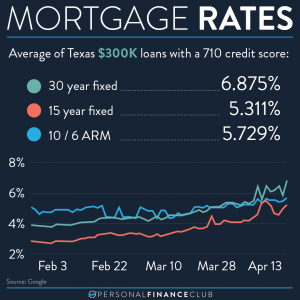

So is it possible for YOU to live that debt-free life? Probably! Although it will definitely take some time. It might mean downgrading a car, curbing spending, and being more aggressive about paying down debts. You can even pay off your MORTGAGE. One quick way is to sell your house. But if you don’t want to do that, paying some extra each month can dramatically reduce the time and interest paid on a loan!

Once you’ve got the monkey off your back, it really opens up your financial freedom playbook. It feels good not to owe the bank. I recommend it.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy