Nathalia is a real person. You can find her at @mom_money_boss .

At a young age, she immigrated to the US with her family from Guatemala. Her mother was not great with money and had even declared bankruptcy at one point.

Nathalia graduated from college with $20K in student loans. When she got her first full time job at 22, she started contributing to her 401k without understanding what it was.

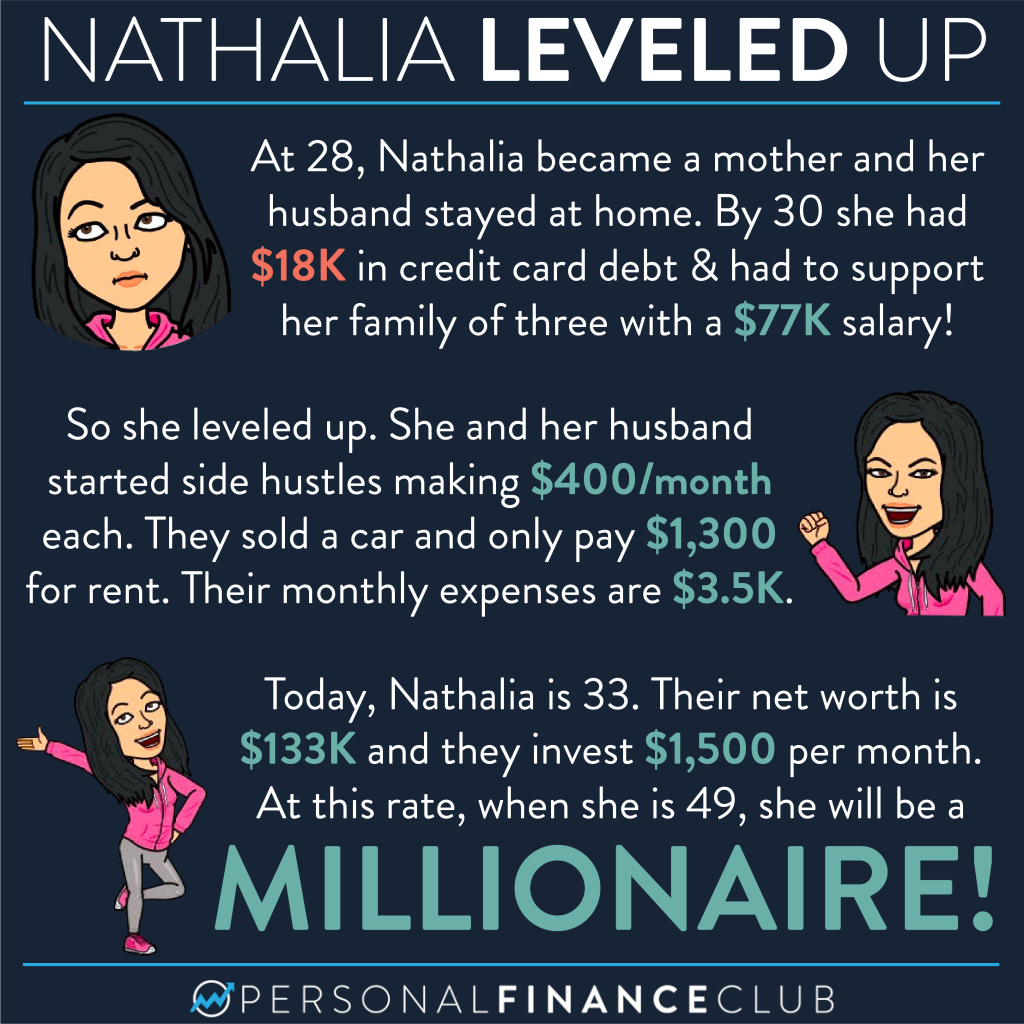

At 28, Nathalia became a mother. Her husband became a stay at home parent while she was the sole breadwinner. She has been supporting her family with a salary of $77K!

Life was stressful, which caused Nathalia to overspend money by escaping to happy hours and dinners with friends. By age 30, she had accumulated $18K in credit card debt. She decided it was time to get it together.

Nathalia got serious about budgeting and found a method that worked for her. Their rent is $1,300 living in California. They even sold one of their two cars in order to pay down debt and reduce expenses. After cutting down spending, their monthly living expenses are $3.5K for a family of 3!

To bring in more income, she started a side hustle hosting educational workshops and her husband is a part time contract delivery driver. They bring in about $400/each per month.

Every month, they invest $1,500. The rest goes toward their emergency fund, sinking funds, & debt.

Remember that 401k that she didn’t know much about?! Today it has grown to $65K and her 457b account has $45K, both in a 2050 target date index fund. She also gets a pension that currently has $35K.

Today, Nathalia is 33, her husband is 34, and their daughter is 4. Their net worth is $133K. At this rate, their net worth will be $1 million by the time she is 50!

Nathalia is a great example that you don’t need a high income in order to become a millionaire or retire early!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram