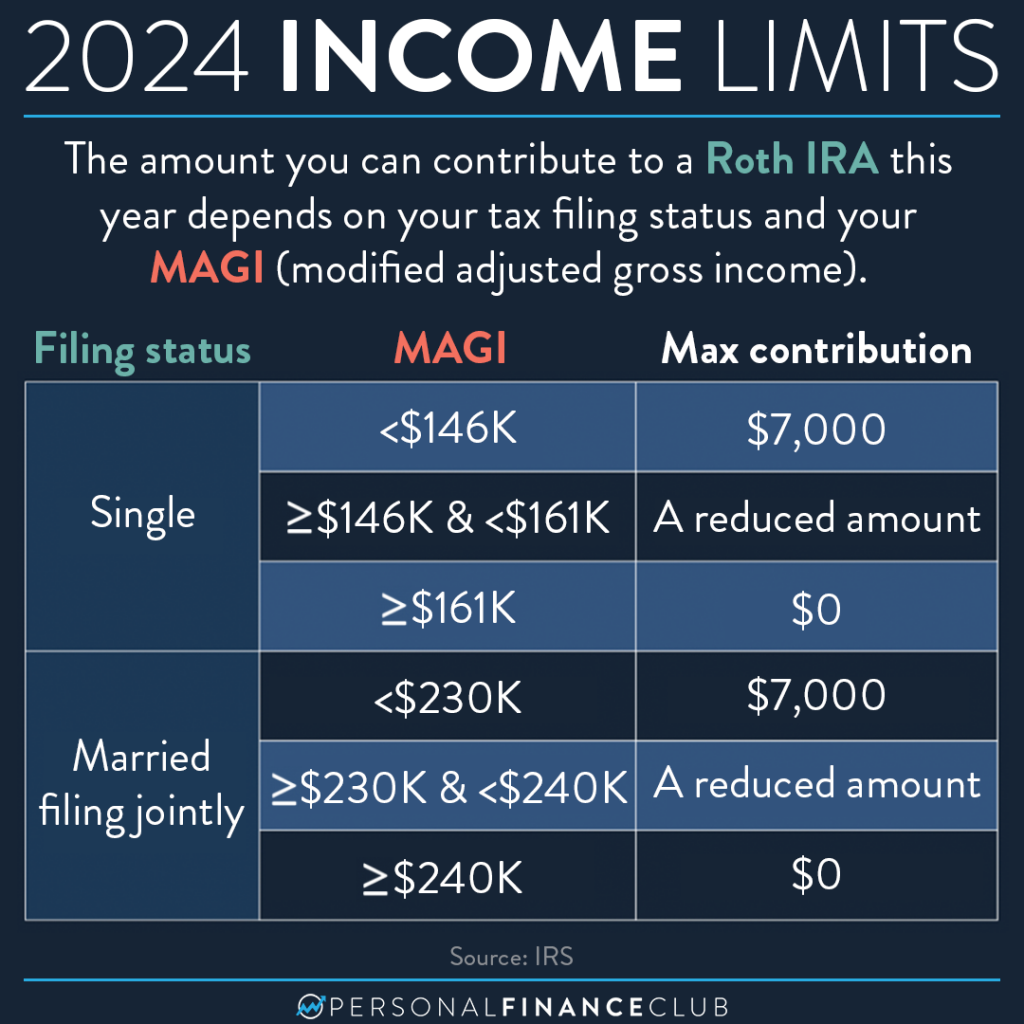

We posted about the updated 2024 contribution limits a couple months ago, but since then we have been getting a lot of questions about the updated income limits as well. So, here they are!

There are other scenarios that we couldn’t fit in the post. For example, if you’re 50 or older, the full amount is $8,000 instead of $7,000! And if you are married filing separately (and living together), if you make over $10K you can no longer contribute. There are also spousal rules as well. So, if one spouse doesn’t earn income, they can still contribute to a Roth IRA.

What happens if your income is above the limit but you want to contribute to a Roth IRA? Well, you are in luck because there is something called the “backdoor Roth IRA” that allows high income earners to still contribute. It’s a (legal) loophole where you contribute after-tax money into a traditional IRA and then convert it to a Roth IRA. And just like that, you have money in a Roth IRA.

HOWEVER, be careful when doing this because you may be subject to the “pro-rata” rule. This means that if you have untaxed money in an IRA, you are not able to ONLY convert the new after-tax money. A proportion of the untaxed money will also be converted into a Roth IRA, which you’ll then have to pay tax on.

If your income puts you within an allowed contribution of “a reduced amount”, how much does it come out to be? The IRS has a formula on how to calculate it. It’s hard to predict your MAGI in advance, so if you’re in this income range it can sometimes be easier to do a backdoor Roth IRA with the full $7,000.

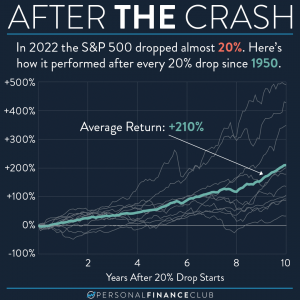

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!