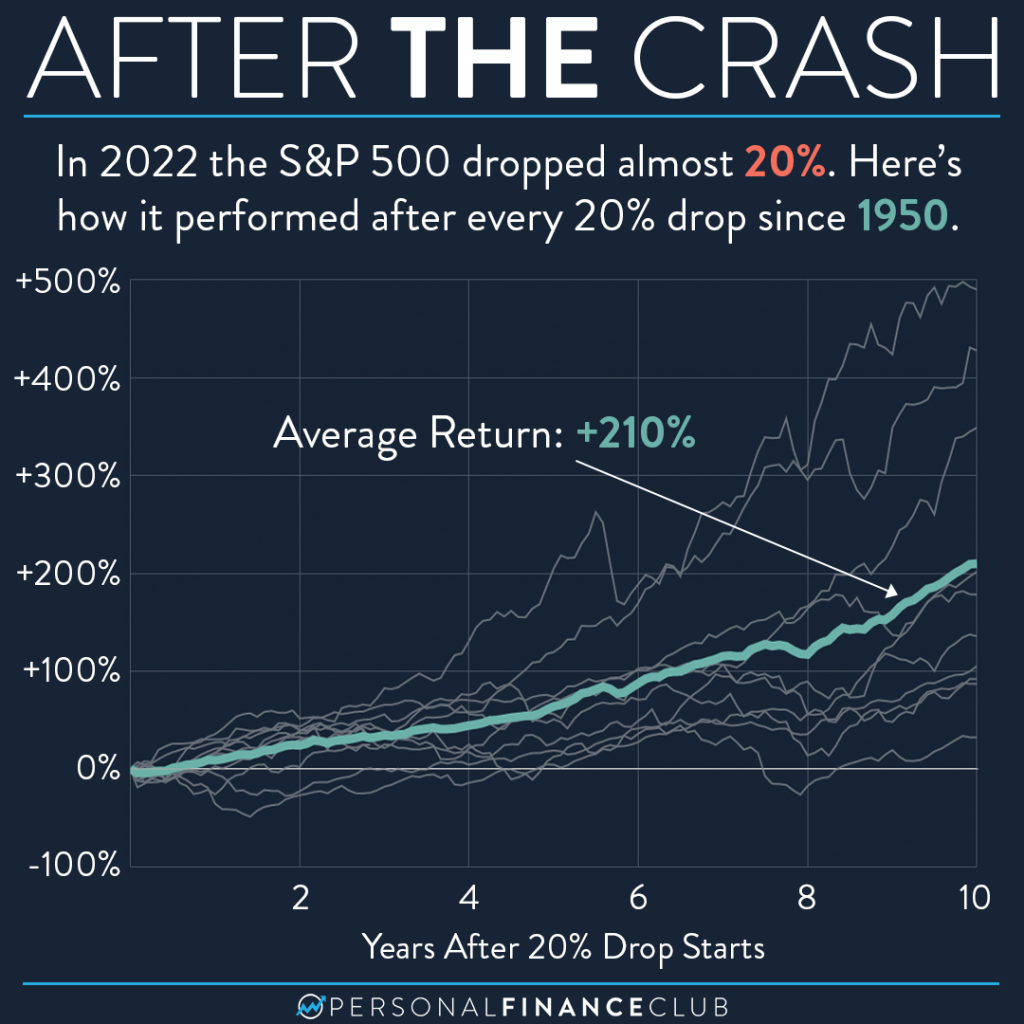

In last Friday’s post (2022 Was A Bad Year), we showed how 2022 was one of the worst years in the history of the stock market. But when we’re thinking long term… it really is not a big deal.

When the stock market falls by 20% that’s called a “bear market”. We spent most of 2022 in a bear market (and are still in one now!). It happens every five years on average and is never any fun to live through.

But, the average return of the market during the 10 years following a bear market is +210%. That’s an annualized rate of +12%, which is even better than the +10% average that we’ve seen throughout the history of the stock market. The best 10 year period was the bull market of the 90s (+490%). And the worst 10 year period was the 2000s (+32%), which included the dot com bubble and housing crisis.

It’s tempting to want to “do something” during these bear markets, but don’t. Trying to time what will happen next is more likely to hurt you than help you. So stick to your investment plan and keep buying… the market will eventually bounce back and you’ll get a huge return. Work to increase your income and put those extra dollars into low cost index funds!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

#bearmarket #stocks #stockmarket #learntoinvest #economics #beautifulgraphs #data #marketcrash #financialliteracy