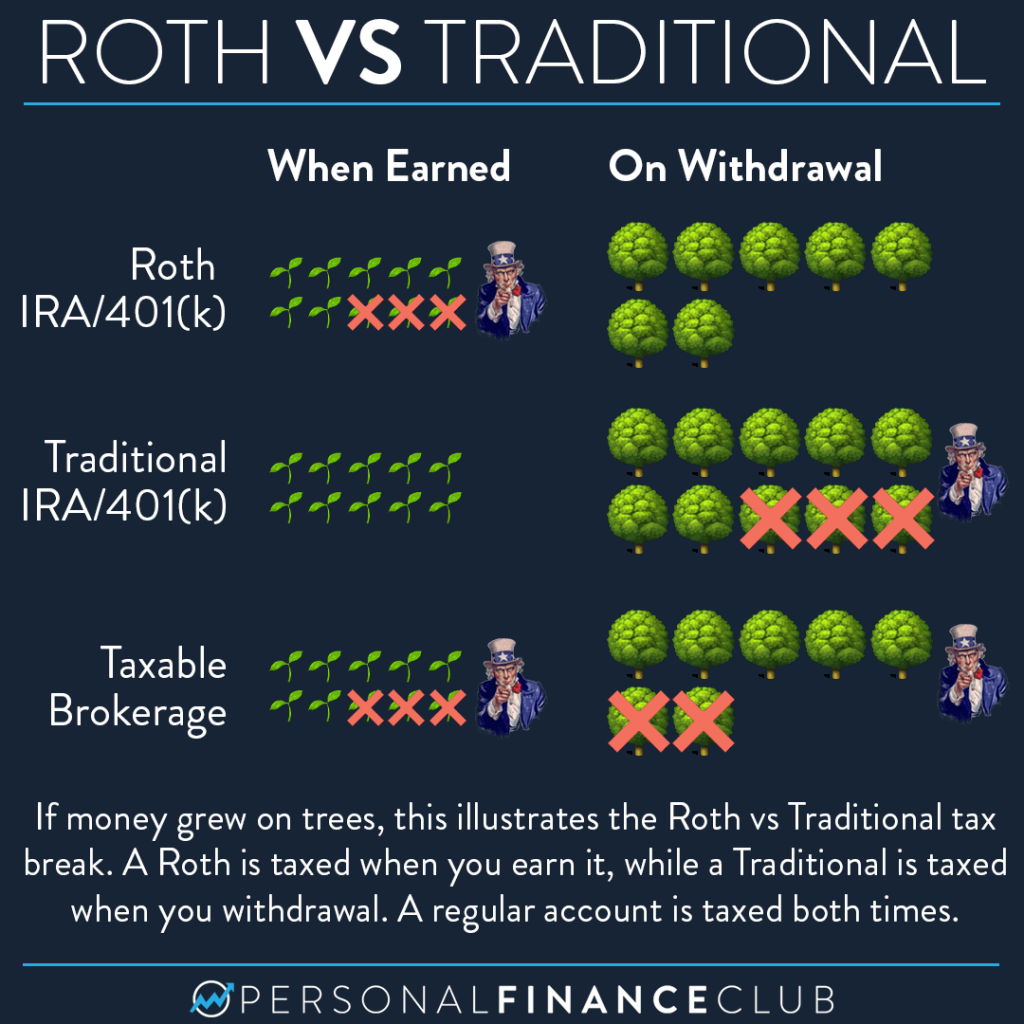

When you earn money, think of it as something to grow. Like seeds you plant in the ground. Years later those seeds turn into mighty trees!

A brokerage account is a bank account in which you invest. If you invest in a normal brokerage account, the government taxes you twice. Once when you earn the money from your job (income tax). Then again on the additional growth of that money (capital gains tax).

But our friendly US government has made us a great deal. If we invest inside of special investment accounts they eliminate one of those taxable steps saving us a lot of money.

In a Roth IRA or Roth 401(k), the government taxes you as normal when you earn the money, but then the money is never taxed again as it grows. So in the tree analogy, “Roth” means the government takes some of the seeds but none of the trees.

In a traditional IRA or 401(k) it’s the opposite. Money comes directly out of your paycheck into the account without being taxed. That lowers your tax burden today, but then you pay tax on the full amount when you withdraw it later. So they let you plant all the seeds, then harvest some of the trees.

In this example it actually works out the same (you end up with seven trees). The difference comes down to your tax bracket now vs when you’re in retirement. It’s a mistake to assume you’ll be in a lower tax bracket in retirement. The goal is to have millions of bucks in your IRAs by then. You want to be able to take out massive amounts at a time without incurring a huge tax burden. The Roth version also protects you against future tax hikes!

Generally, Roth is likely better for younger and/or lower income earners and Traditional is likely better if you’re older and haven’t saved much for retirement yet. There’s even an argument to have some of each. Having some money in “Traditional” status gives you some flexibility to “convert” that money to Roth during low income years. But they’re both better (tax wise) than a taxable brokerage account, so just pick one and start investing!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy