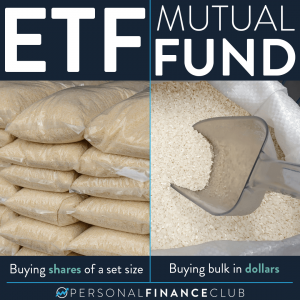

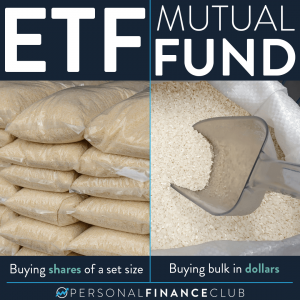

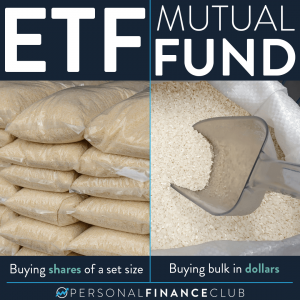

What’s the difference between an ETF and a mutual fund?

First of all, I’d like to be clear that those bags on the left are full of rice, not blow, so save your comments you

First of all, I’d like to be clear that those bags on the left are full of rice, not blow, so save your comments you

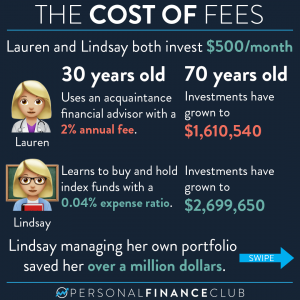

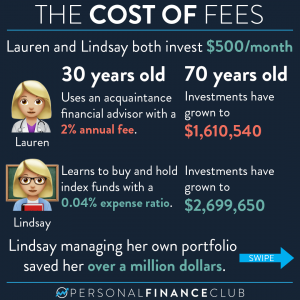

If you have $100,000 to invest and you go to a financial advisor who charges a 2% fee, they’ll take $2,000 per year. That’s a

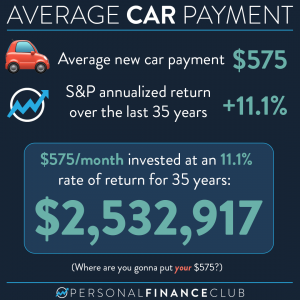

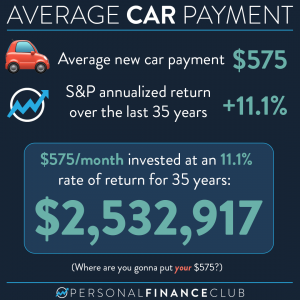

Your eyes do not deceive you. The S&P 500 has had a cumulative annual growth rate of about 11.1% over the last 35 years. And

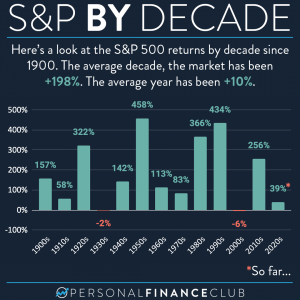

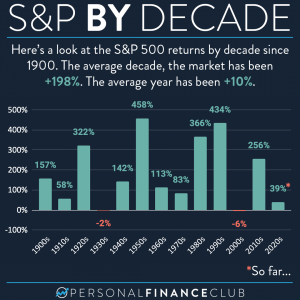

If you invested $1,000 in 1900 in an S&P 500 index fund, today it would be worth over $103,000,000. Well, that’s not possible for a

There’s this idea in pop culture that investing is all sorts of things like: • Difficult • Stressful • Highly risky • Requires deep subject

First of all, I’d like to be clear that those bags on the left are full of rice, not blow, so save your comments you

If you have $100,000 to invest and you go to a financial advisor who charges a 2% fee, they’ll take $2,000 per year. That’s a

Your eyes do not deceive you. The S&P 500 has had a cumulative annual growth rate of about 11.1% over the last 35 years. And

If you invested $1,000 in 1900 in an S&P 500 index fund, today it would be worth over $103,000,000. Well, that’s not possible for a

There’s this idea in pop culture that investing is all sorts of things like: • Difficult • Stressful • Highly risky • Requires deep subject