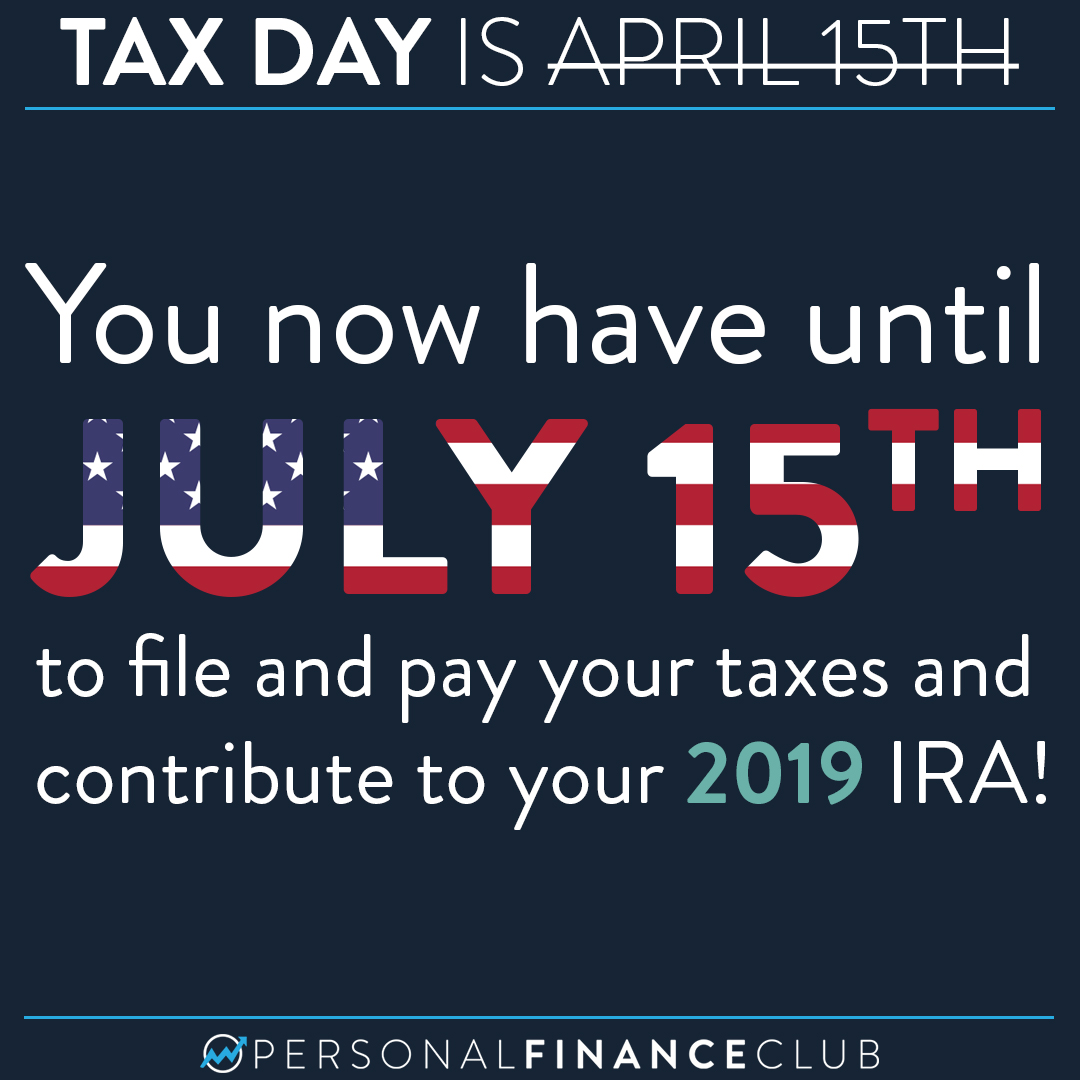

Here’s some good news coming among all the craziness. We now have until July 15th to file and pay taxes. The IRS has confirmed that also extends to your 2019 IRA contribution. So if you haven’t yet contributed $6,000 to your 2019 Roth IRA you can still do so until July 15th.

A few notes:

• If your income is or may be affected, or you have debt other than your mortgage or you don’t yet have an emergency fund, then it’s not time yet for you to invest. Get your income stable, debt paid, and emergency fund in place first.

• Up until July 15th you can actually choose for your IRA contribution to count towards 2019 or 2020. Always choose the older year because it’s use it or lose it. You have until tax day 2021 to fill up your 2020 contribution.

• Even though the contributions are classified based on the contribution year, all the contributions can go into the same account. (i.e. if you contribute to your IRA six years in a row, all the contributions can go into the same account and be invested in the same index fund)

• Don’t forget after you contribute money to INVEST that money. I love investing in target date index funds! Check the “How to Invest” story highlight for more info.

• The market may go down more over the next year, or it may go back up. (It was up over 7% on Monday!). No one knows what the market will do in the short term. But in 20 years, when you’re looking back you’ll wish you invested over the last 20 years. So get started now! (If you’re out of debt, etc)

As always, reminding you to stay healthy by following the two PFC rules: 1.) Stay at home and 2.) Wash your hands early and often.

– Jeremy

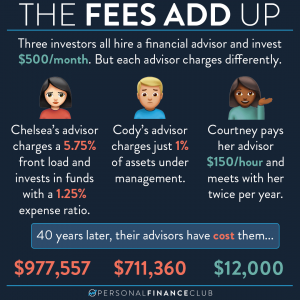

How much do financial advisors’ fees cost?

Charging a percent of “assets under management” is a really great business model for financial advisors. They spend their first few years in the industry