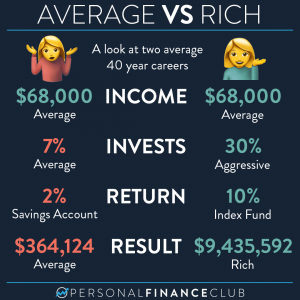

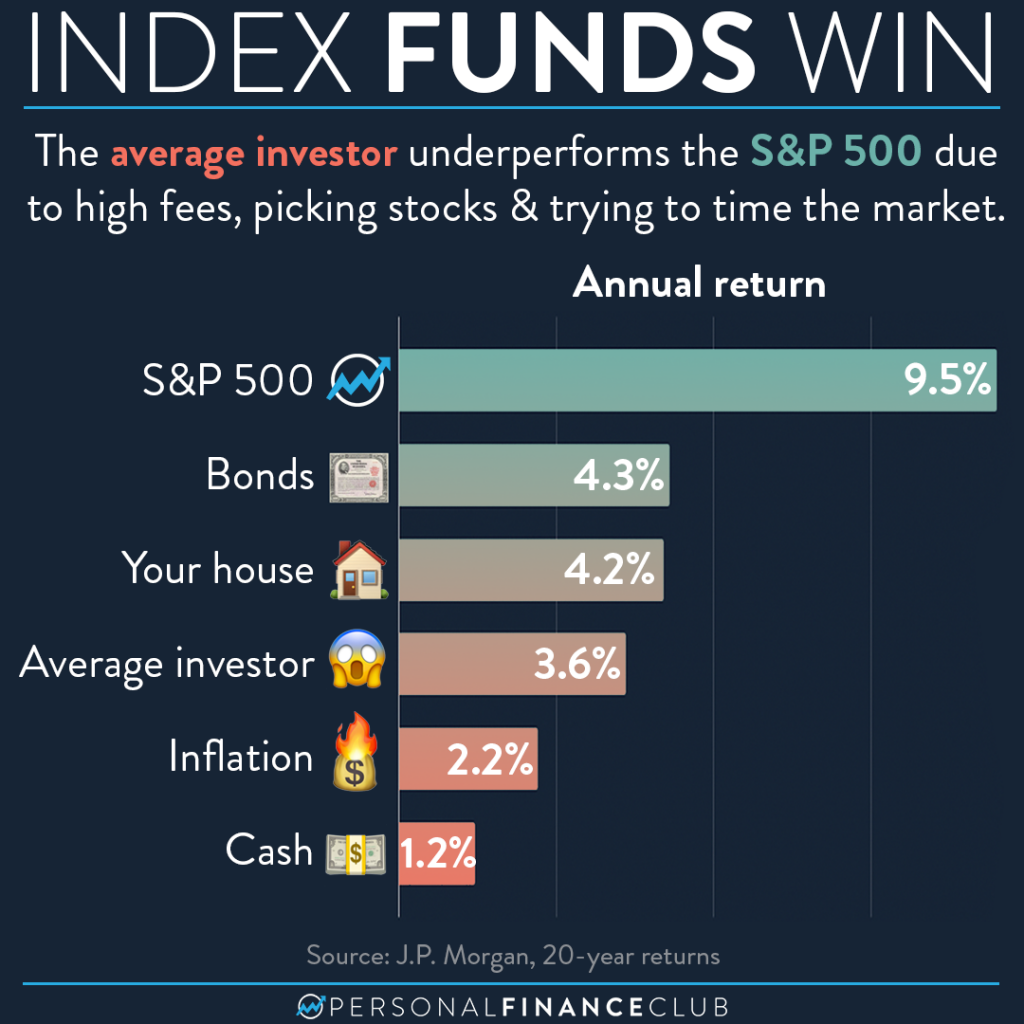

Consistently investing in index funds can make you rich. It sounds simple, but the unfortunate part is most people never do this. J.P. Morgan did a study recently that showed the average investors’ performance is way behind the return of the S&P 500 index.

Investing is one of the areas of life where the harder you work, the worse the results are. If you spend all day researching stocks and trying to figure out what the market will do tomorrow, you have a high chance of doing worse than if you spent 60 seconds purchasing an index fund.

Many people think they can time the market. Even right now, a lot of people hear about things like the debt ceiling and inflation and they choose to sell their stocks, with the intention of jumping back into the market later. But, it’s impossible to time the market with any degree of consistency.

What do you do? Make your investing life simple. Spend less than you make. Take the difference and plow it into low cost index funds. Automate this process so every month you are buying more.

Real estate in this example refers to your primary home, not investment properties. Investment properties have other ways of helping you build wealth, like rental income. Whereas your primary residence has underperformed stocks and represents an expense.

For anyone who wants to learn more about index investing, we have a big sale on both our “Build Wealth by Investing in Index Funds” and “How to Money Like a Millionaire” courses starting this coming Tuesday!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!