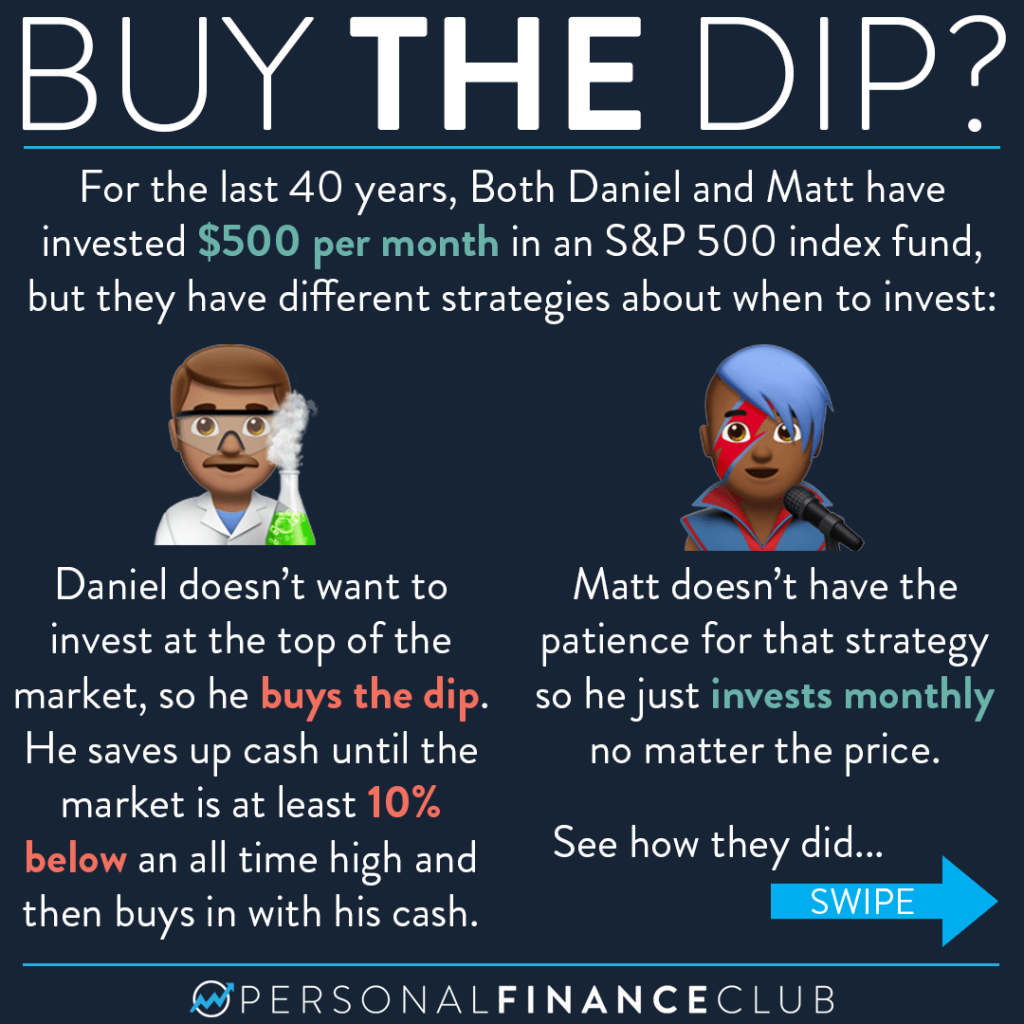

This year has been kind of a rocky ride for the stock market. There’s been at least 5 times where the market has had a pretty step little drop of at least a few percent. We currently sit about 5% below the record high set about a month ago. A nice opportunity to buy, right?!

Well, despite being “down 5%” right now, the market is actually up about 16.4% year to date. So if you had cash on the sidelines waiting for that 5% dip, you missed the 21% runup. Not to mention, that cash on the sidelines is earning about 0% interest, while money in the market is collecting, and reinvesting dividends that whole time.

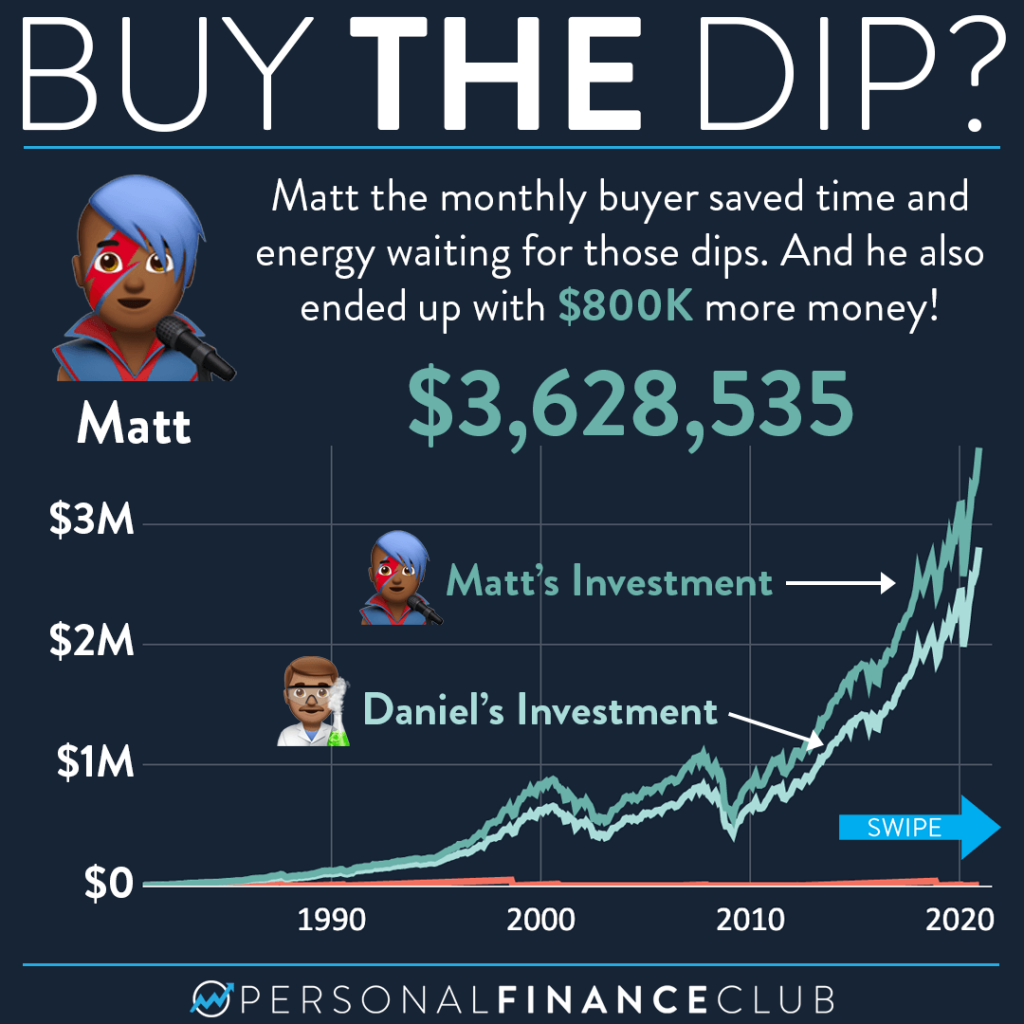

“Buying the dip” is a catchy little phrase, and I do like that it encourages investing even during a downturn, but it’s not a sound strategy. That money you were gonna use to buy the dip should have already been in the market, or should be scheduled to go in with your scheduled investments. Any sort of human decision making on when to jump in or out of the market is a form of timing the market which is much more likely to hurt you than help you.

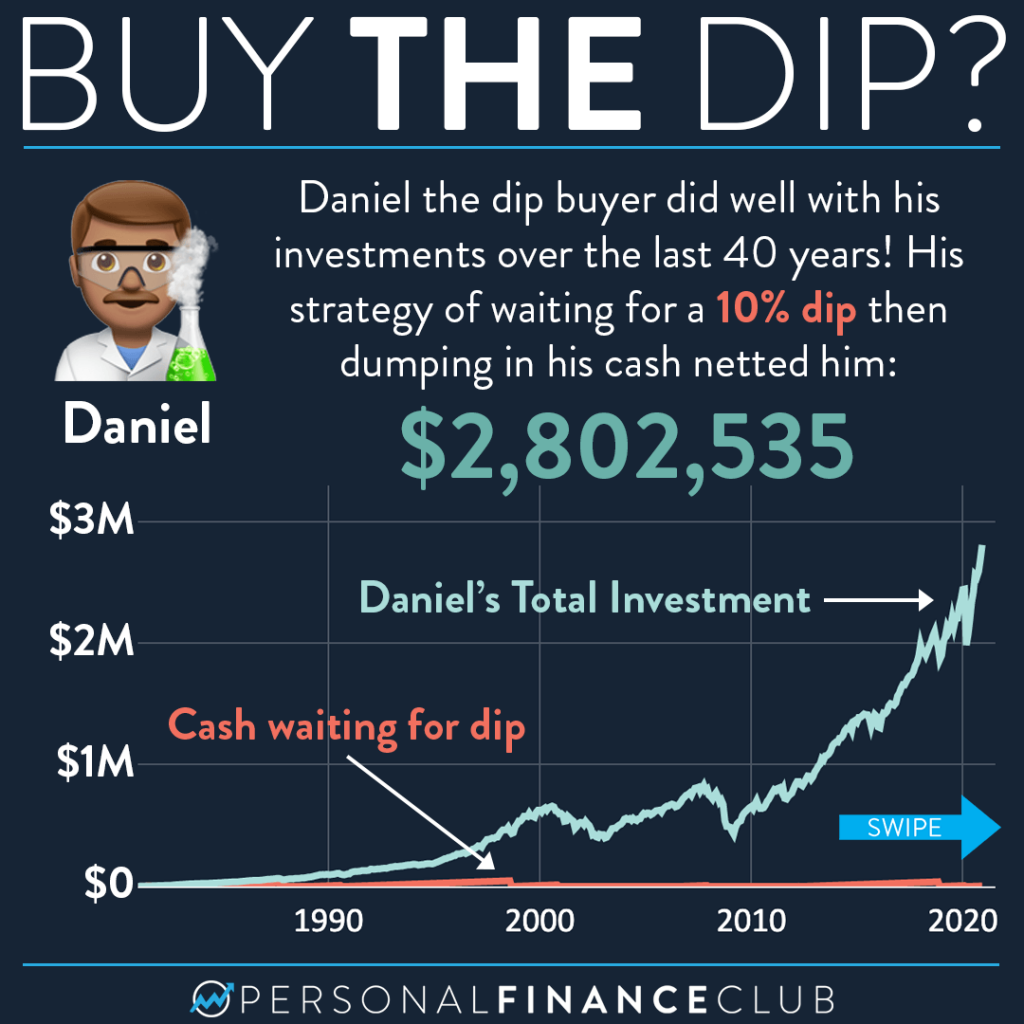

The 10% dip Daniel waited for is pretty arbitrary. I ran with several numbers over the last 40 year stock market data. The bigger the dip you wait for, the more it hurts you. But it never helps you. Here are some examples:

• Waiting for a 1% dip leaves you with 2% less money

• Waiting for a 5% dip leaves you with 9% less money

• Waiting for a 10% dip (example in post) leaves you with 22% less money

• Waiting for a 20% dip leaves you with 43% less money… ouch!

We don’t know when a crash is coming. We don’t know if a 5% dip will turn into a 20% crash. We simply can’t time the market. So keep it simple. Invest your cash when you get it and don’t sell anything until you retire. Then, just sell what you need to live on each year. That’s optimal investing.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram