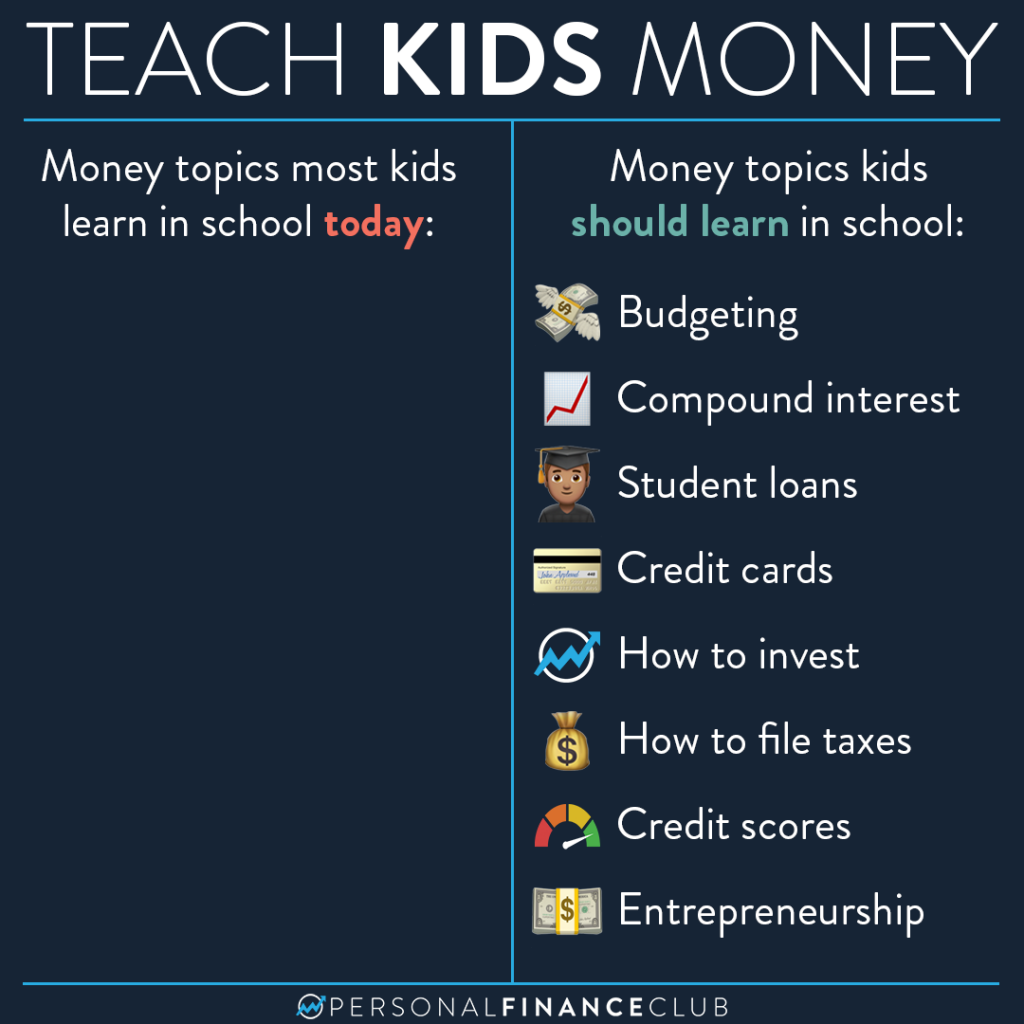

We are dumped into the world of personal finance with little education. We often rely on being educated from Wall Street firms or insurance companies, who are usually just trying to sell us stuff we don’t need.

Think about a typical personal finance journey. You graduate high school with zero education on money. You’re told it’s okay to get six figures of student debt to go to college. At college, there are credit unions offering “free” credit cards to students.

After college, you start making income and somehow have to figure out how to pay taxes, pay off student debt, start saving, and so on. And then, this is usually the same time that society starts putting pressure on you to buy a house.

Thankfully, there is a lot of progress being made in this area. More and more states require personal finance to be taught in high school. And even anecdotally, we get messages regularly from teachers asking if they can use our posts to teach personal finance to their students.

P.S. The title of this post very much aligns with our friend Maya’s mission over at @teach.kids.money !

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!