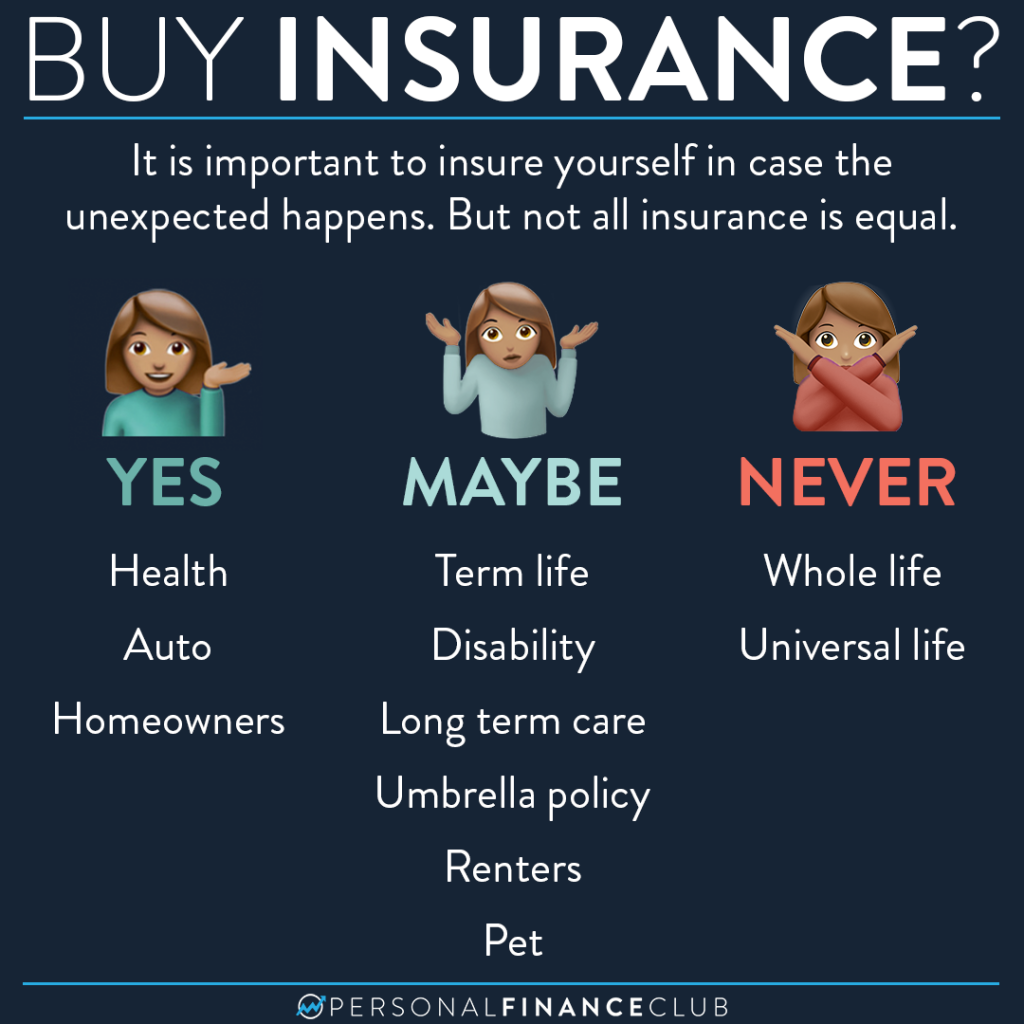

Insurance isn’t fun to pay for. Until something bad happens and we wished we had more of it. But in some cases, you’d be better off saving and investing the money instead.

We are headed into open enrollment season in the next couple of months. Take the time now to review what insurance you have through your provider and make sure it is up to date and best suited for you / your family.

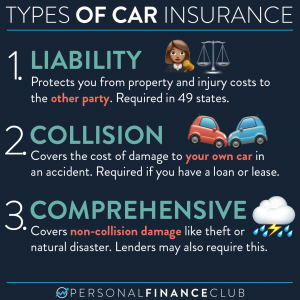

The “ALWAYS” column is self explanatory. If you have a car, get car insurance. If you have a house, get homeowners insurance. If you are alive, get health insurance. These are probably your most valuable possessions and the cost of NOT being insured can be detrimental.

The “MAYBE” column depends on your overall situation. For example, term life insurance would be important to have if anyone depends on your income/work to survive. But if you have a high net worth and have no dependents, you may no longer need a term life insurance policy.

You likely already know our view on whole life, universal life and other cash value life insurance policies. Stay far away from it. They are expensive and overly complicated. You will get pushy sales people trying to sell it to you from time to time. They will come up with all sorts of clever narratives for why you should buy their product, but don’t fall into their trap.

We are hosting a free “Insurance 101” webinar this coming TUESDAY (9/12). We will talk about all of these topics in simple terms. We’ll go over how insurance works and how much of it you need. And we will leave room for a Q&A at the end! Check our bio for more info!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane