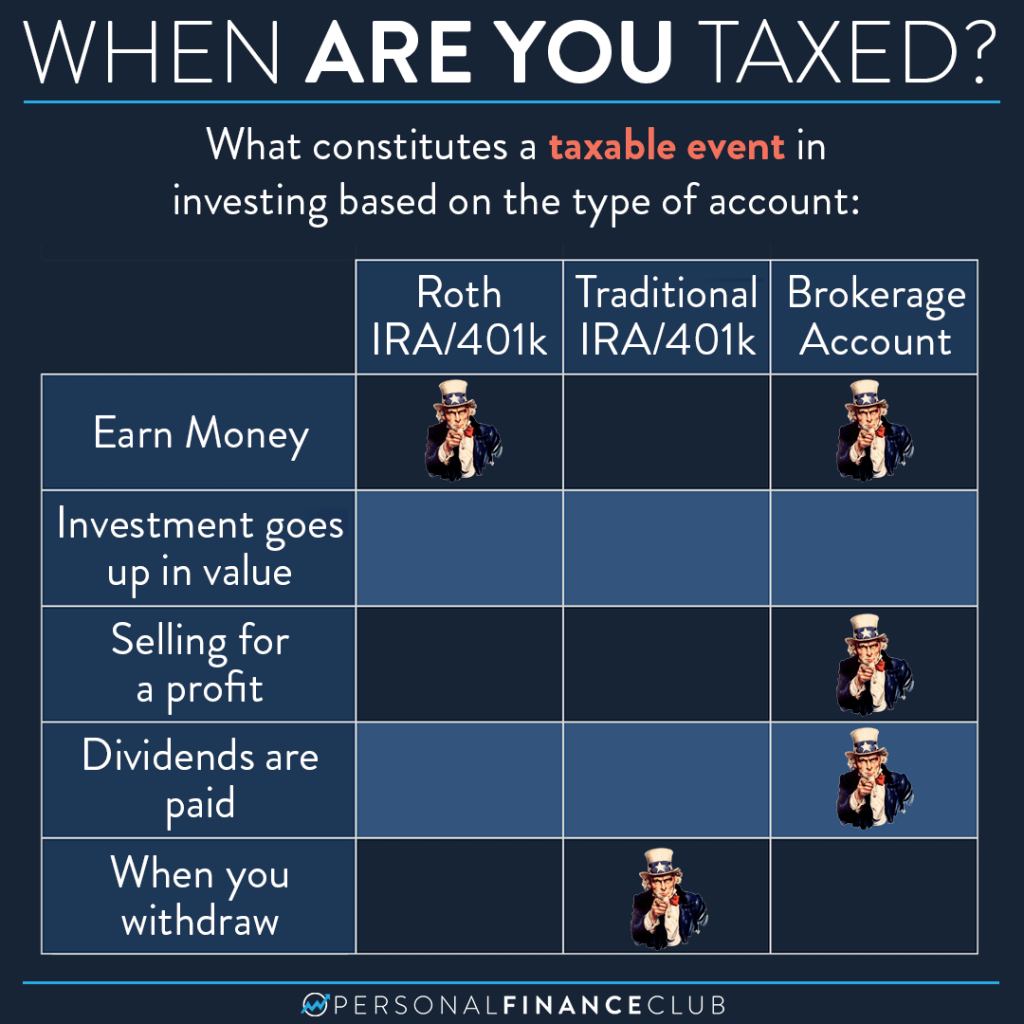

Believe it or not, this 3×5 table with some Uncle Sam graphics is a slight simplification of the US tax code. But I think it hits some major points that can confuse new investors. Let’s walk through it by account type:

Roth IRA: If you invest inside a Roth IRA (or any other Roth account like a Roth 401k) that money is taxed when you earn it, then NEVER TAXED AGAIN (assuming you leave it in there until you’re 59.5). So when your investment goes up in value, pays dividends, and when you take it out, it’s all 100% tax free. You can day trade to your little heart’s content inside a Roth IRA and not pay any capital gains as that money is shielded from taxes. (I don’t recommend day trading)

Traditional IRA: If you invest inside a Traditional IRA (or any other “Traditional” retirement account like a Traditional 401k) that money goes straight into the account tax free! So if you earn $60K in 2022 and contribute $10K to a Traditional account, you’re taxed in 2022 as though you only made $50K. Then you’re never taxed on any gains or dividends while it grows. After 59.5 years old when you start withdrawing, you pay tax on what you take out as though it’s new income, like from a job.

Brokerage Account: This is a “normal” account without any of the tax benefits from above. When you deposit money to a brokerage account it has already been taxed from your income. When an investment you own pays a dividend, that will be taxed the year the dividend is paid. If you sell an investment for a gain, you pay capital gains tax just in the increase in value. BUT if an investment goes up in value and you DON’T sell, you’re not taxed on that yet. i.e. Let’s say you bought $500 worth of Tesla stock, then it went to $5,000, you have an “unrealized gain” of $4,500. But if you don’t sell the government isn’t going to tax you on that until you sell and “realize” the gain!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram