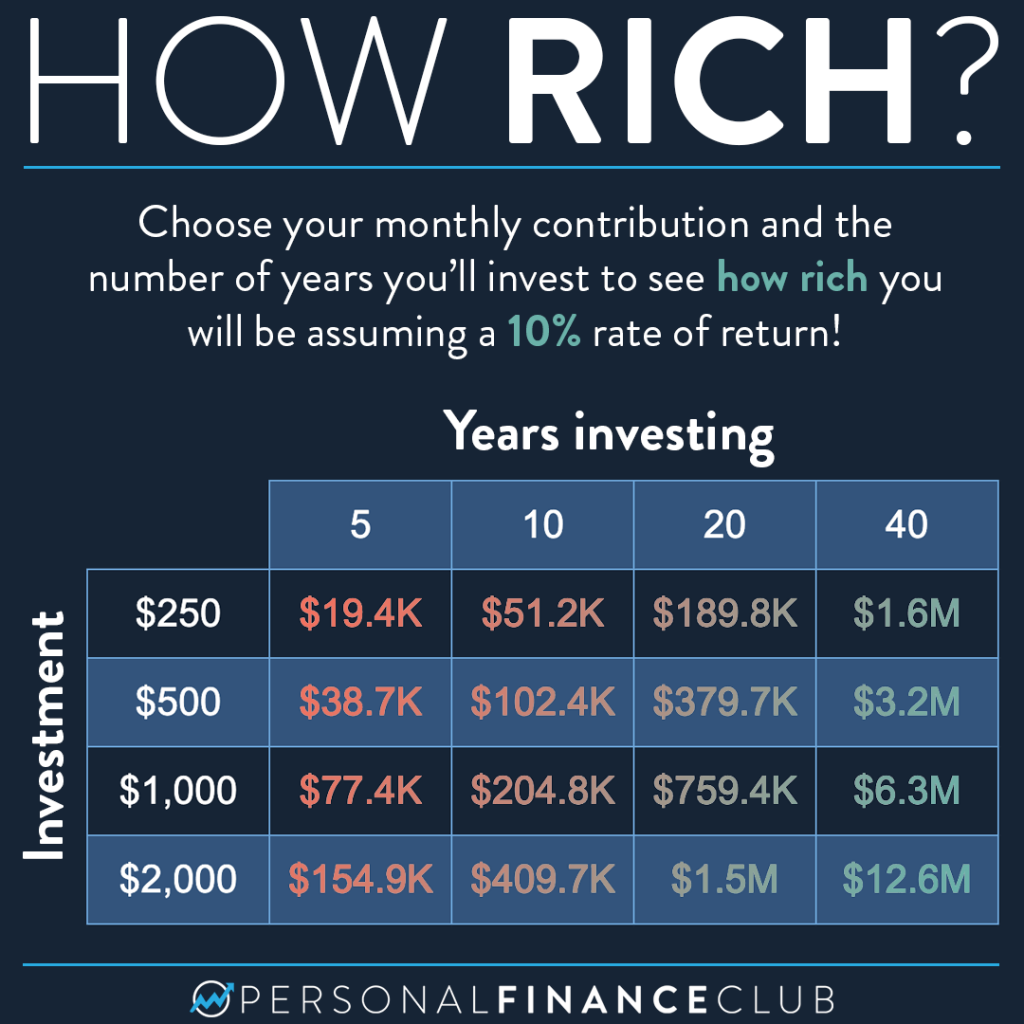

I wish I could tell you there’s some tricky secret to investing that will make you rich overnight. It would honestly be a more exciting and compelling message. But it’s not true. The truth is investing really comes down to math. It’s about building wealth by acquiring assets that provide income and go up in value over time. The more money you put in, the more comes back. The longer you invest, the larger the investment grows. It’s straight up math.

This table shows you some options based on a 10% return. “TEN PERCENT RETURN?! ARE YOU CRAZY JEREMY?!”, you may be asking yourself. And the answer is no, I’m not crazy. But that’s what a crazy person would say so I’m not sure you can trust me.

So where does that 10% number come from? Over the last 40 years, the US stock market has produced a compound annual growth rate of 11.3%! Was that a good 40 years? Sure. But over the last 100 years, it’s been about 10%.

Will that keep being true in the future? I can’t know for sure, but I do know that owning a share of companies that do business, generate revenue, and pay profits back to the owners is a good way to build wealth. And want to know the most efficient and low cost way to own ALL those companies? It’s by buying an index fund!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy