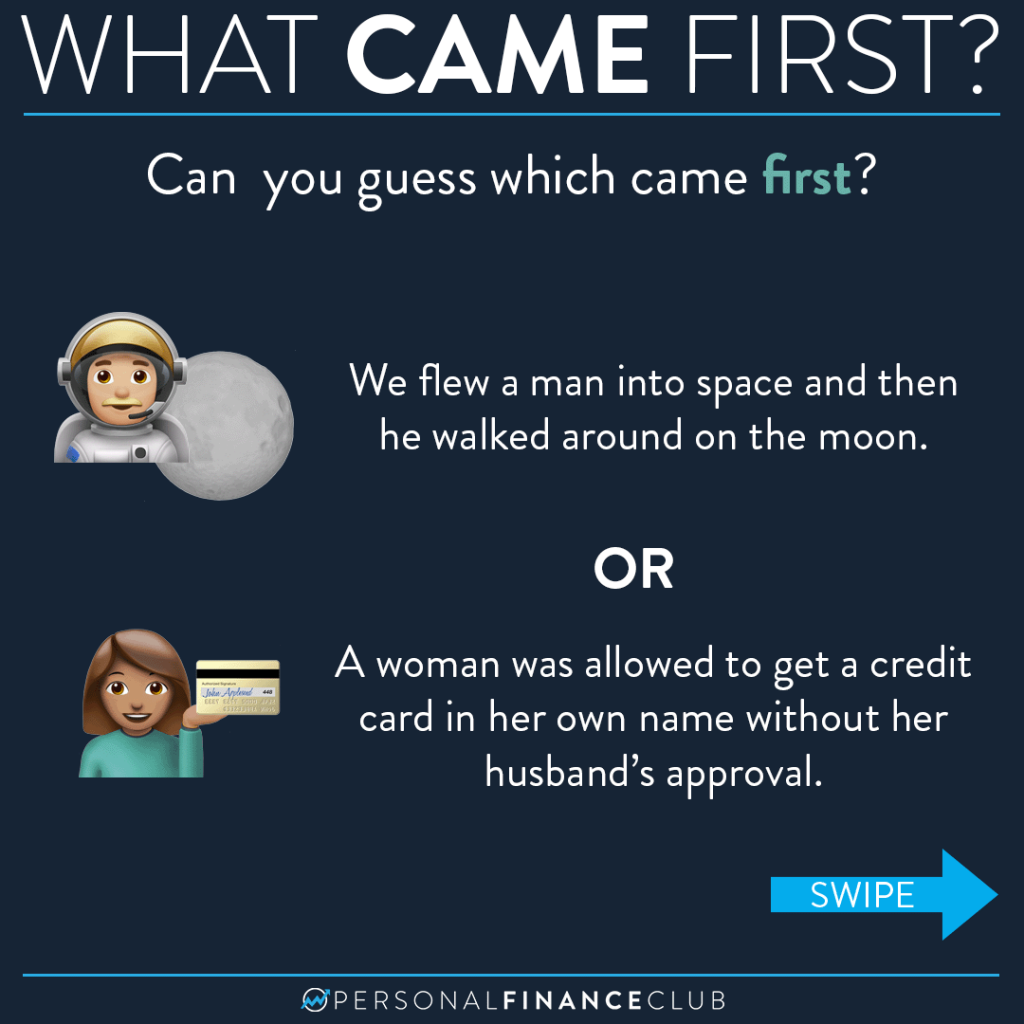

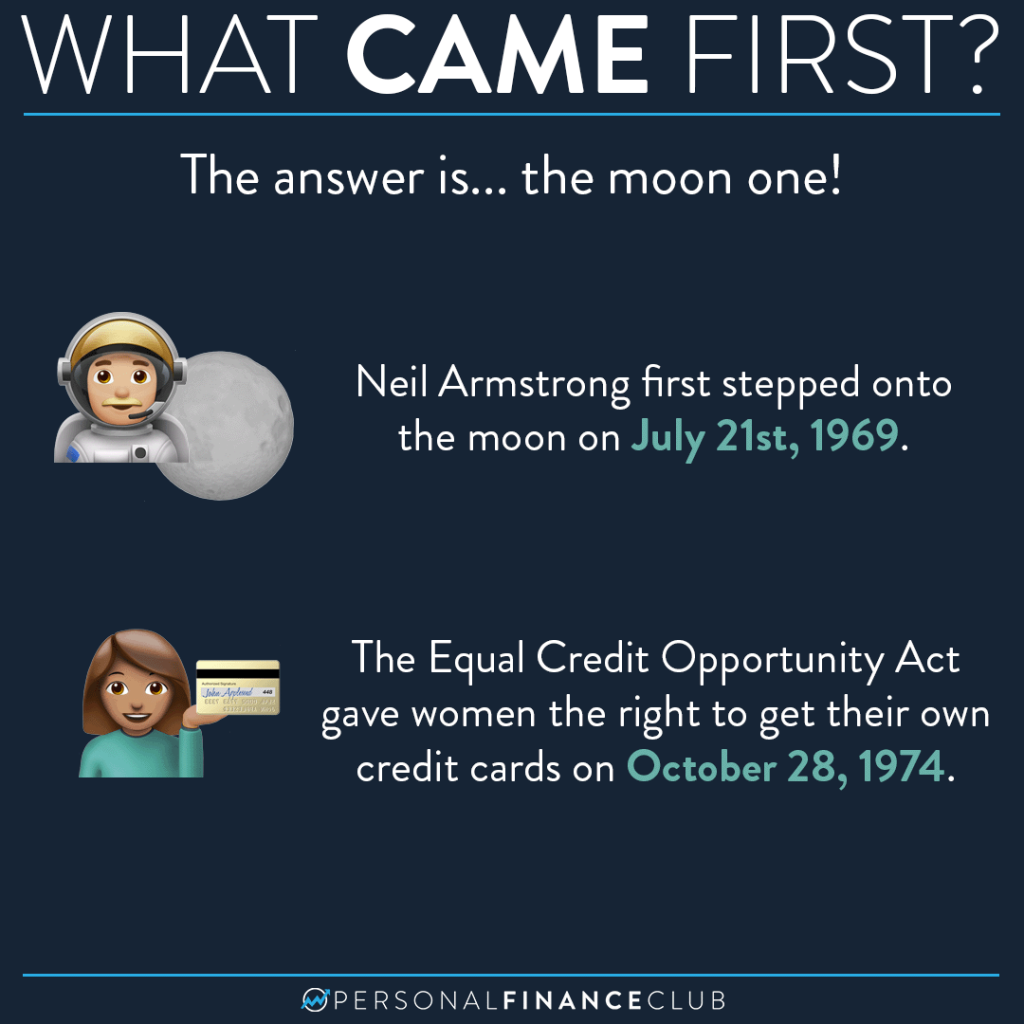

My mom recently mentioned to me that she wasn’t allowed to have a credit card in her own name when she got married. The skeptic I am, I guffawed at that idea. That only a few years before I was born (in 1980) we lived in a country where a man had to approve his wife’s ability to have a credit card?! (Not to mention women who weren’t married 😮) It seemed absurd to me.

But sure enough. Before 1974 it was fully legal (and common practice from what I can read) that banks simply wouldn’t issue credit to women, preferring instead to include them along with their husbands on applications.

Thankfully the Equal Credit Opportunity Act (ECOA) was introduced by Representative Bella Abzug in 1973 and signed into law by President Gerald Ford on October 28, 1974. Notably, Abzug and Ford were members of opposing political parties. Wouldn’t it be nice to work together again in the name of progress?!

Whenever we make a post touching on the existence of politics, gender, race, diversity, etc, there’s a small but vocal portion of the comment section screaming at me. Things like “stay in your lane”, “what’s this have to do with personal finance”, or much less nice name calling. While these comments give me life and I want to roll around in them like a dog rolling around on a dead bird, I’ll still address them here:

The economy is made up of people doing work, buying things, innovating, etc. When those people aren’t treated fairly, not only is it bad for the individuals, it’s bad for the economy. We’re a country of enormous talent. And we’re at our best when the best individuals can rise to the occasion to provide value. When we have a lack of diversity, that points to a lack of equal opportunity (the other explanation being racism). And it’s a problem we should fix if we’re serious about performing the best as a country.

Women not even being allowed to participate in credit markets as recently as around when I was born is a reminder of how current this problem is, and how we should keep striving to do better.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!