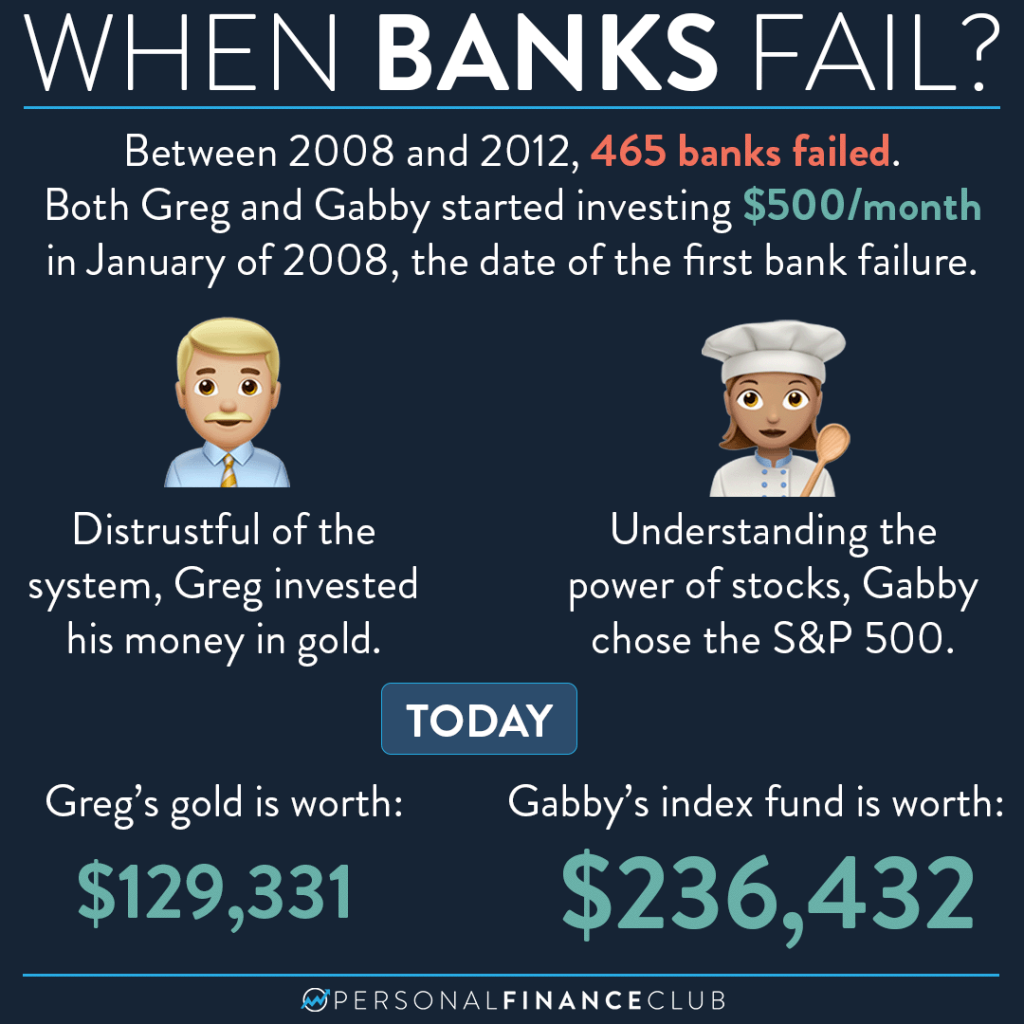

Banks failing isn’t good. But as with all macroeconomic happenings, it doesn’t mean an individual investor should try to make tricky moves to do something about it.

I’ve been getting a lot of questions like “should I pull out my money” or “what should I do in response to this bank failing”? The answer is keep doing exactly what you’ve been doing. Spend less than you make. Invest the difference in index funds. Banks are still safe, and cash is insured by the federal government up to $250,000 per depositor per bank.

IN MY PERSONAL OPINION, I don’t think we’re going to see anything near a cascade of bank failures like we did during the 2008 financial crisis. But EVEN IF WE DID, look at what the best thing to do back then would have been. It would be to stay the course and keep investing early and often.

These economic pullbacks are half cyclical, half unpredictable. We know over the course of several decades we’ll see several periods of rate increases, recessions, market pull backs, etc. You can count on it. But we simply can’t know when they’ll happen, the scale, or the duration of them. Instead of trying to agilely make money moves to avoid the inevitable downturns, charge through and look at them as an opportunity to zig when everyone else is zagging. Keep investing early and often. When the market inevitably rebounds (which it will) you will be handsomely rewarded!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy