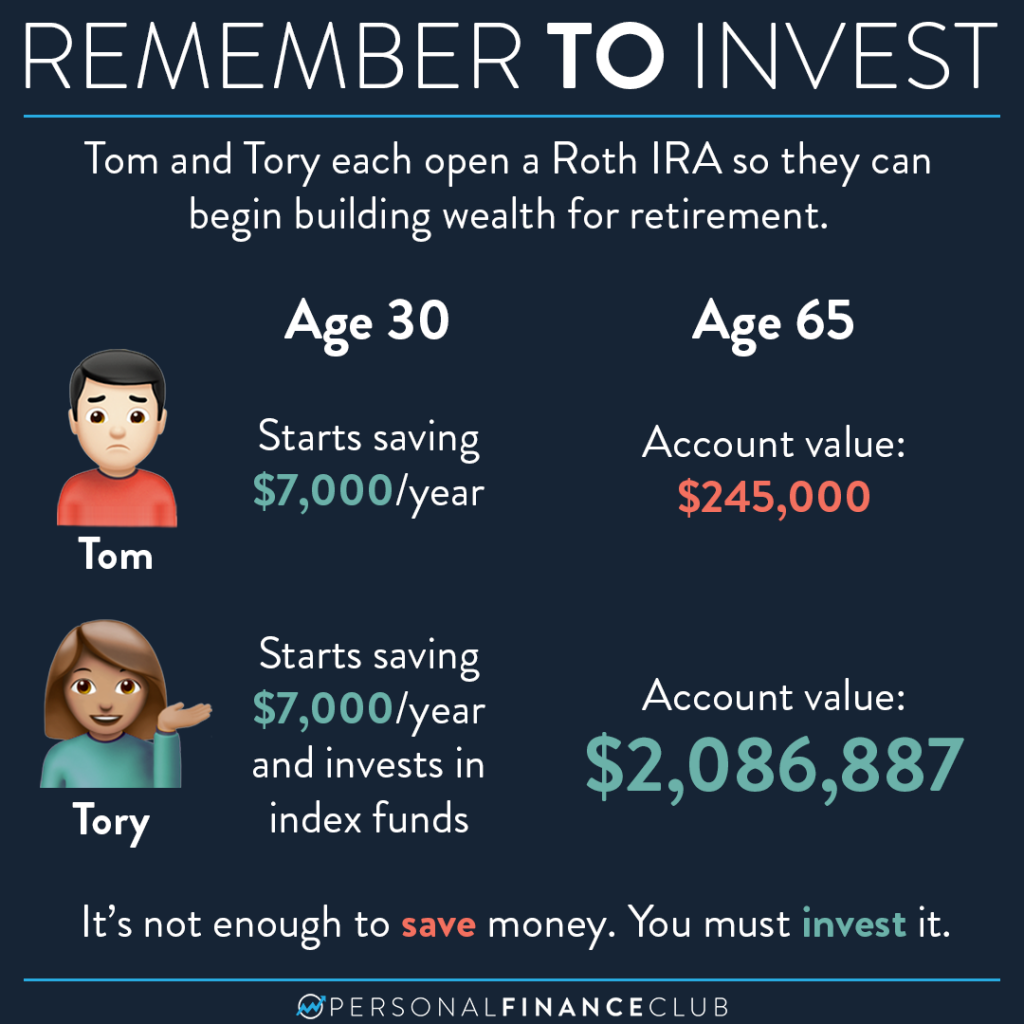

Forgetting to invest in our example, resulted in an almost $2 MILLION dollar mistake. Don’t let this be you. Stop what you’re doing and make sure the money in your investment accounts is actually invested!

The mistake of contributing to your IRA but then not actually investing the money is FAR too common. And there is no worse place to do it than in a retirement account since that account is usually for long term wealth building.

In our example, we are assuming Tom and Tory contribute $7,000 into their Roth IRAs since that is the new max contribution for 2024. They invest in an index fund that tracks the S&P 500, which has had a 10% annual growth rate over the last 100 years, including dividends.

So, make sure you are investing your retirement savings. If you don’t have the money, invest a very small amount. Getting started can be the hardest part. There will always be reasons to delay getting started. But, starting now instead of later can make a huge difference.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane