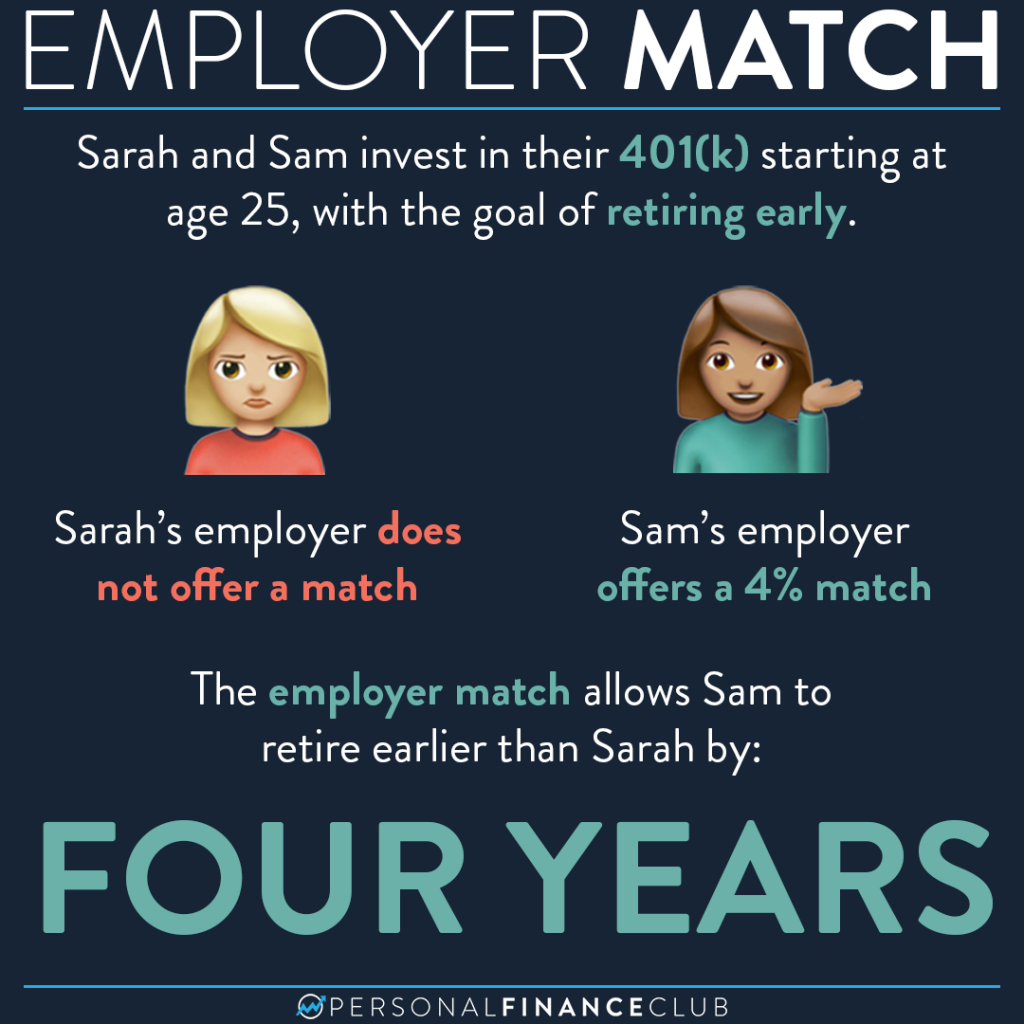

Does your employer offer a 401k? If so, does it include a company match? Unfortunately, this is out of your control as an employee (unless you switch jobs!). But, this seemingly minor detail in your benefits package could make a BIG difference to your retirement!

We wrote 401(k) in the post, but the same concept applies for any employer retirement plan (403b, TSP, etc). For background, when a company provides its employees with a retirement plan, they decide if they want to offer a match. This matching contribution is intended to make it more attractive for employees to want to work at the company and to motivate employees to invest for their retirement!

The employer match offers an immediate and guaranteed 100% return on the investment you make. Failing to maximize the benefit of your employer’s match is akin to wasting a portion of your earnings every year! Even if you don’t like the investment options available in your retirement plan, it’s still worthwhile to take full advantage of the employer match.

This example makes a bunch of assumptions, like a 7% rate of return on investments, a 3% annual raise, and a retirement goal of 25X annual spending. Your situation is different, but free money is still free money! When job searching, make sure to take the match into consideration as part of the total compensation. And, always make sure to take advantage of this match if it is available to you!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane