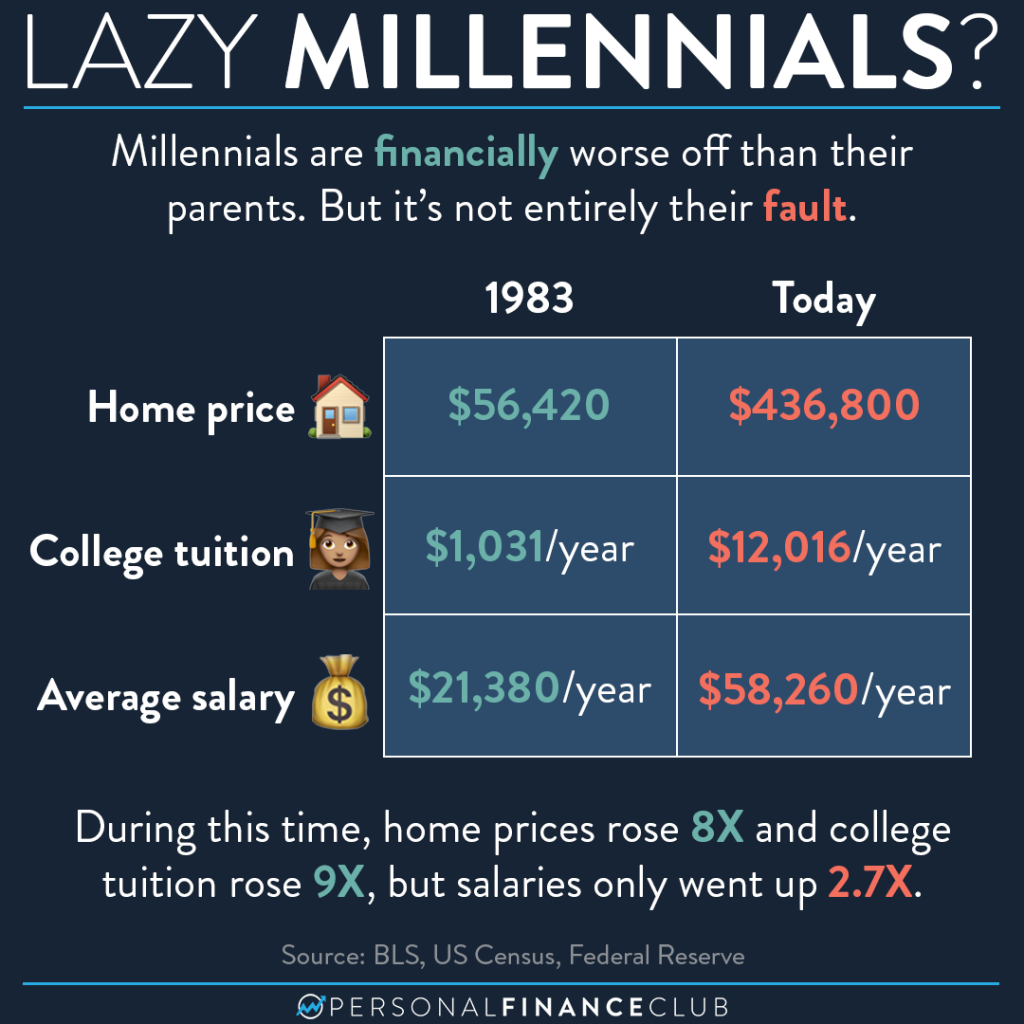

Yes, millennials make poor money decisions especially from all the avocado toast we buy. On DoorDash. But besides that, we’re up against some bad odds when it comes to personal finance.

Overall inflation was up 205% over the last 40 years, but two of the biggest financial commitments the younger generation can face, college tuition and buying a home, are up WAY more than that. And salary increases have not come even close to keeping up.

The problem is this turns into one big vicious cycle. The younger generation takes out student debt to pay for ridiculously priced college. Then they are saddled with the debt when they enter the workforce so they aren’t able to save enough to buy a house. Then by the time the loans are paid off, home prices are nowhere close to affordable. And so on and so on.

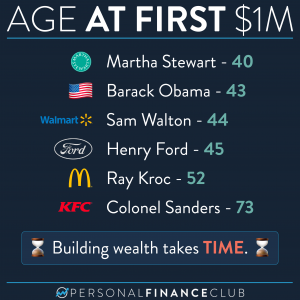

So, what do you do? For starters, it’s a waste of time to worry about anything that is in this post because it is not in your control. Focus your energy on things you do have influence over, like increasing your income and investing as much of it as you can. Do this over a long period of time and no matter what is happening with the price of college, homes, and anything else, you will be able to build massive wealth.

We are using the average cost of a public four year college per year. We didn’t even factor in room and board, which obviously would make it that much higher.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane