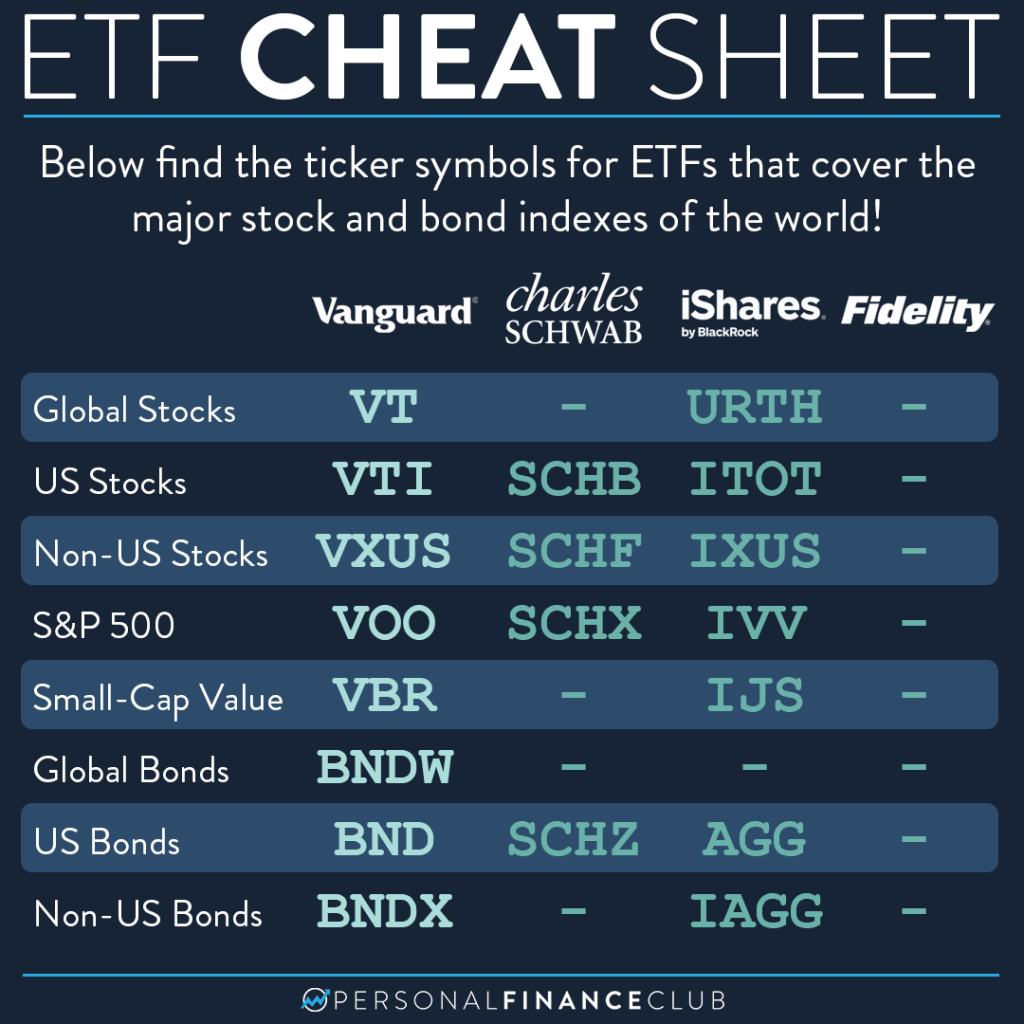

THIS IS CONFUSING, I know. But after days of contemplation and hours of graphic design, this is the best way I know to show what’s going on. Let me explain:

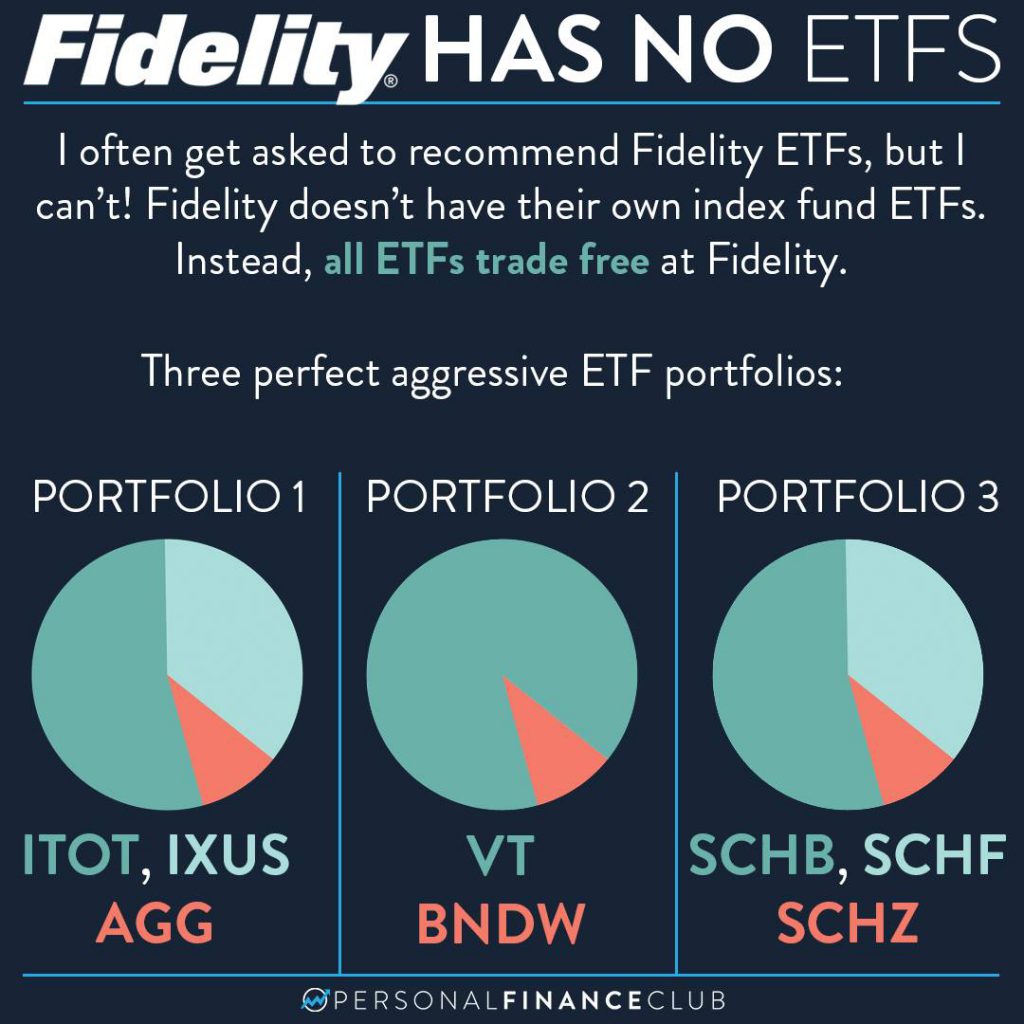

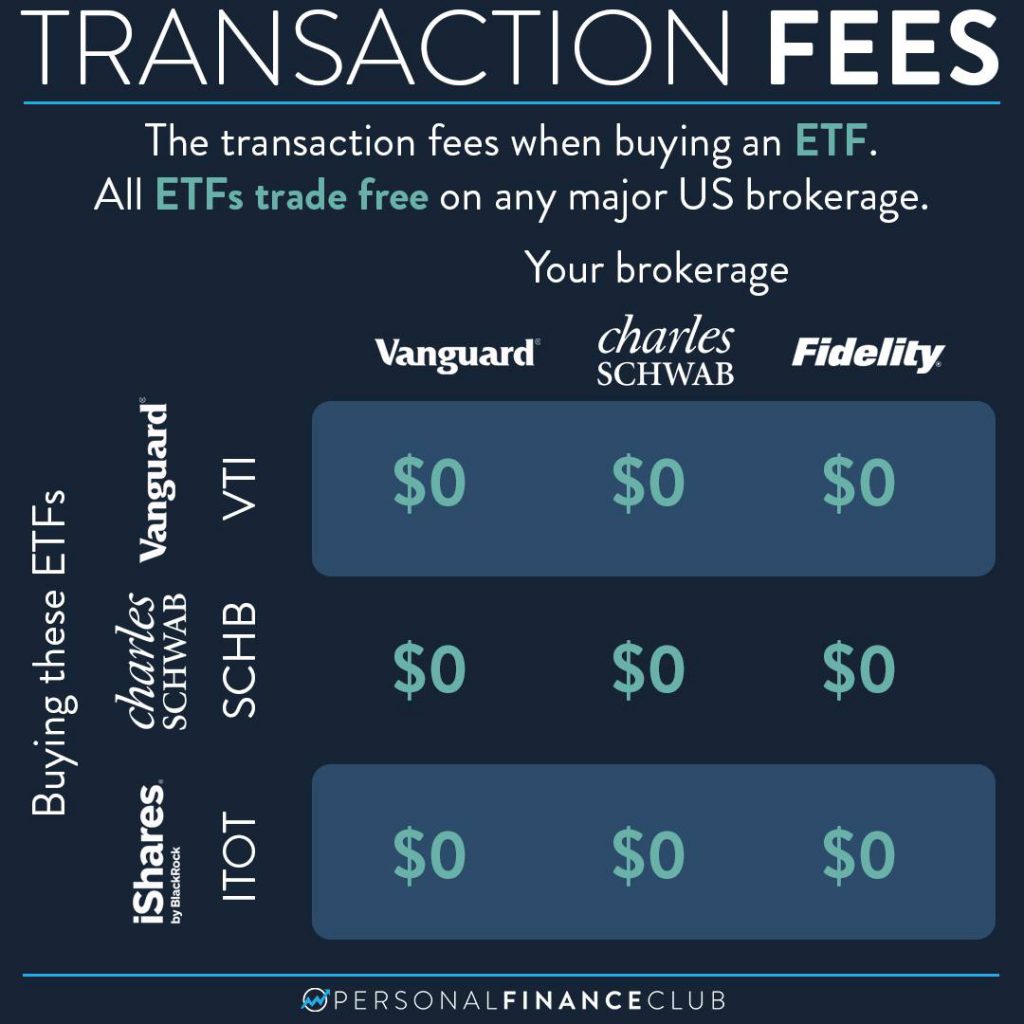

A few days ago I posted “four perfect ETF portfolios” using Vanguard ETFs as an example. Approximately one million people commented something like “Can you tell me the ticker symbols for Fidelity?” My answer was: Fidelity doesn’t offer index fund ETFs. But, EVERY ETF trades free on Fidelity (and every major US brokerage) so it doesn’t matter which brand of ETF you use.

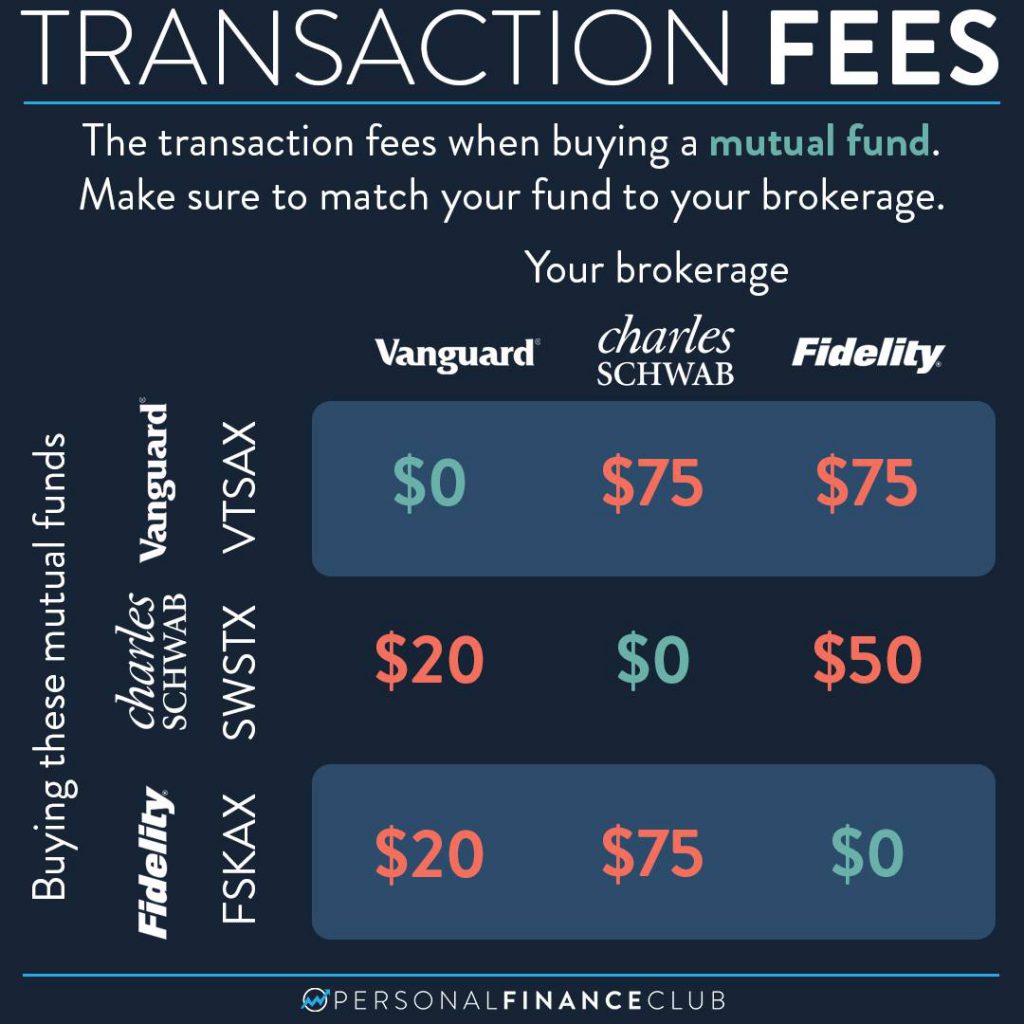

That’s great, except you may have also heard that you should always match the fund you’re buying to your brokerage or you’ll pay a transactional fee for buying a competitor’s fund. That’s true, but for whatever reason it only applies to MUTUAL FUNDS. Examples of mutual fund index funds are VTSAX, SWTSX, and FSKAX). That’s what the third slide shows. If you buy one of those funds from a competitor you get hit with a transactional fee.

But if you’re buying ETFs (like VTI, SCHB, or ITOT) those trade with no transactional fee on ANY brokerage.

So, if you’re investing with fidelity and want to buy a total US stock market index fund mutual fund version, you could buy FSKAX and pay no fee. OR you can buy ANY ETF and pay no transactional fee.

From my experience, and from talking to at least one insider, Fidelity struck a deal with Blackrock / iShares back in the day to NOT create their own ETFs and instead promote the iShares version by giving their customers free trades for iShares ETFs. In exchange, Blackrock gave Fidelity a nice kickback. But when Robinhood came out and forced the whole industry to go to $0 ETF transactional fees, that iShares/Fidelity benefit kinda blew up and Fidelity got left with no ETFs of their own and letting all ETFs of their competitors trade free.

WEIRD AND CONFUSING, I KNOW. I’m doing my best here, but hopefully this helped at least one person sort it out in their head.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy