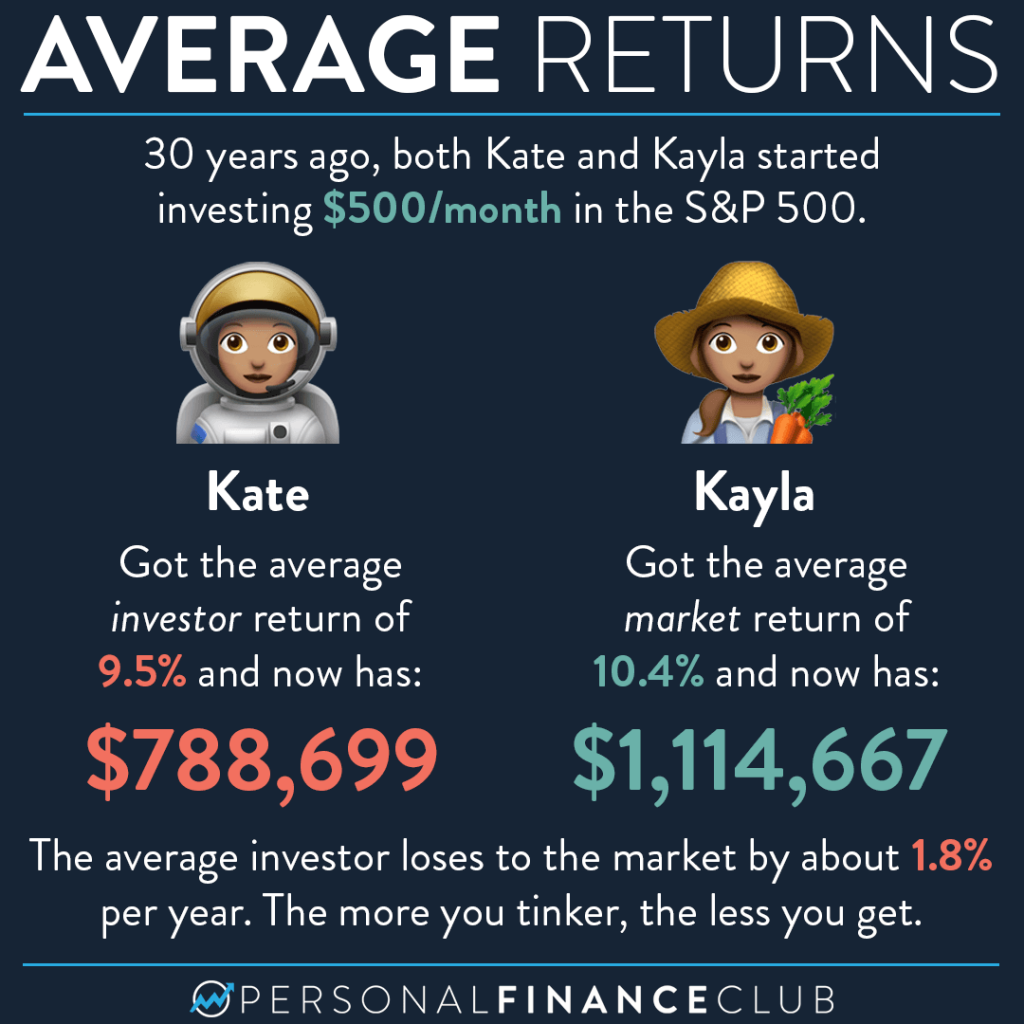

Research done by Dalbar consistently shows that the average investor loses handily to the market. Why is this? Because every human instinct we have about investing is wrong.

Market is crashing?! Sell before it’s too late! Market is at an all time high? Terrible time to get in! Fund has been under performing? Drop it for one that has done great recently! Those are all BAD instincts. They’re examples of trying to be clever to outsmart the market when doing NOTHING (except regularly buying and never selling) would yield better results.

I see it all the time. Remember all the HYPE around the ARKK ETF? Around the beginning of the year I heard nothing but ravings about ARKK. The past returns were incredible. Cathie Wood is the golden child of investing with brilliant vision about emerging technologies. Investors POURED their portfolios into the ETF in January expecting those returns to continue. Since then? ARKK has returned -11.2% while a simple total market ETF (like VTI) has returned +15.2%. An underperformance of 26.4% in only 10 months. Quite impressive indeed.

With just a few moves like that, you can begin to see how the average investor underperforms the index by about 1.8% per year. And as this graphic shows, the resulting impact to your portfolio can be devastating.

If you want better returns, do less. Less trading. Less tinkering. Less timing the market. Set up automated investments into a target date index fund on a regular schedule. Buy and hold. Don’t sell anything until you retire. Invest like a sociopathic robot.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram