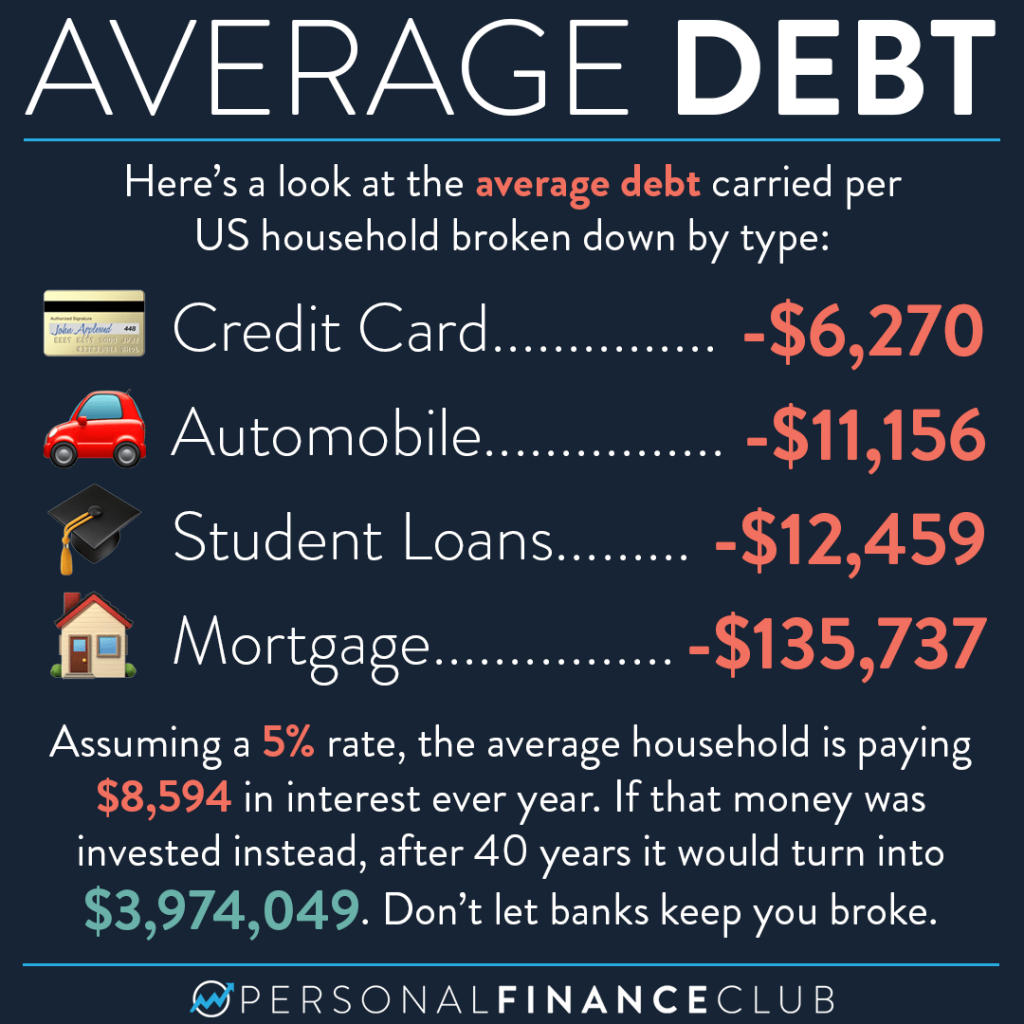

Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

The average debts listed here represent the bad kind of compound interest. It’s the kind of compound interest that keeps you dragging yourself to a job you hate for decades just to make payments while you never seem to get ahead. And when you walk into a big city and stare up at the towering skyscrapers, representing billions of dollars of real estate, with bright signs atop that say things like “Bank of America” and “Wells Fargo”, do you know where they get all that money? From the what’s pictured in this graphic. Regular working people slaving away at jobs in order to make their $8,594 worth of payments every year.

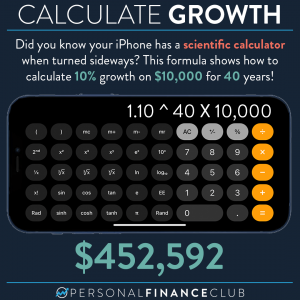

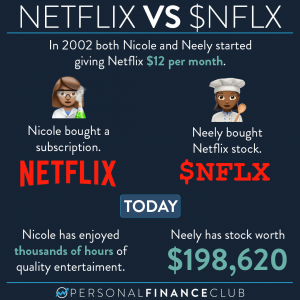

Meanwhile, investing is the good kind of compound interest. It’s putting your money out in the world in productive assets (like index funds or investment real estate) so it works for you and comes back bigger and bigger over time.

Don’t buy into the debt mentality. It only benefits the banks. Live below your means. Pay off all your debt. Invest those former debt payments. That’s how rich people get rich.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

p.s. Thanks to @brandonslyko for the post idea!

via Instagram