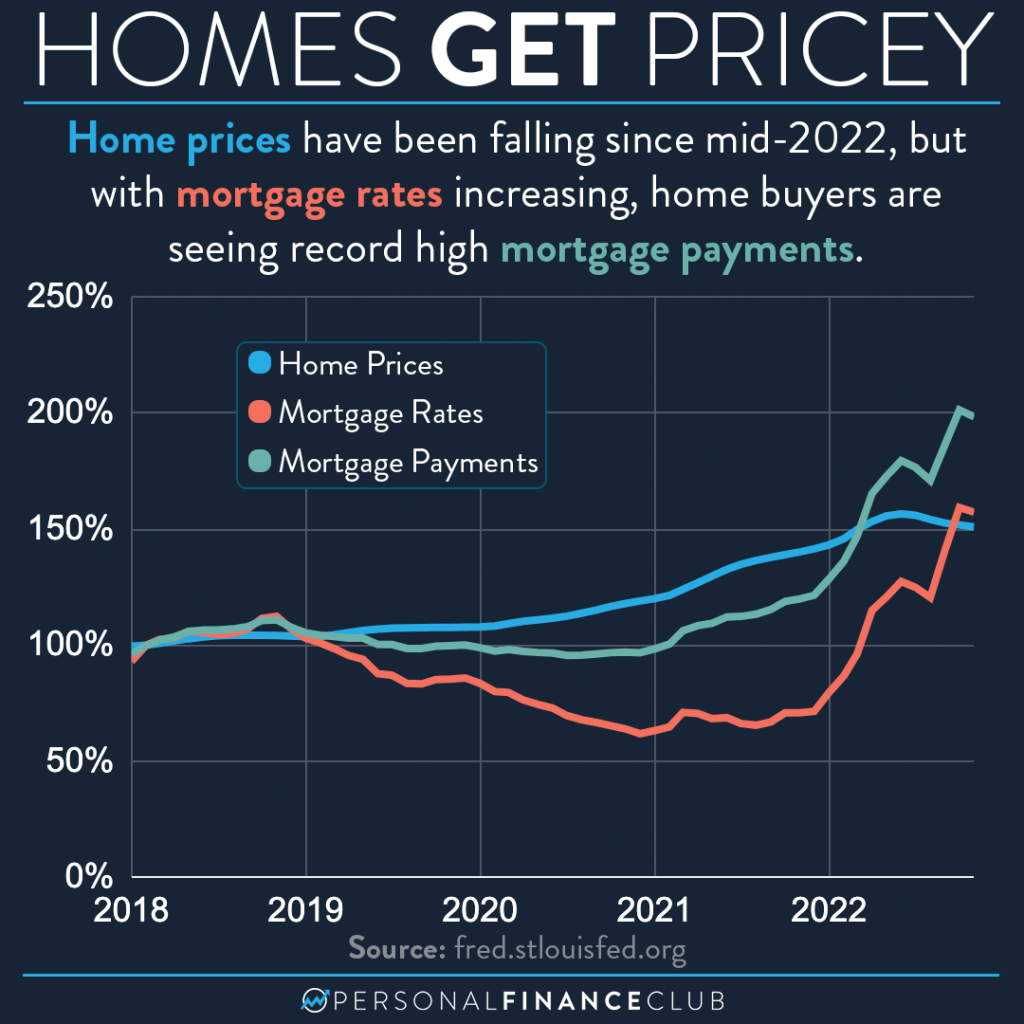

A line like “record high mortgage payments” isn’t all that interesting because something like that is almost ALWAYS true. Since things go up in price, we’re generally always paying “record highs” for stuff. But the interaction between home prices, rates, and mortgage payments is interesting. From late 2018 to late 2020 the US average mortgage payment was actually slightly falling even though home prices were rising. That’s because mortgage rates were falling.

But over the last year or so we’re seeing the opposite. Rates are going WAY up, and home prices are coming down just a little bit. Rates are increasing faster than home prices are falling. That means the average home purchase mortgage payment in 2023 is about TWICE what it was in early 2018!

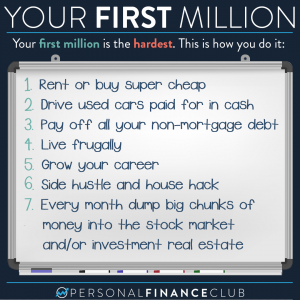

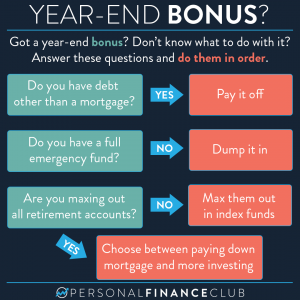

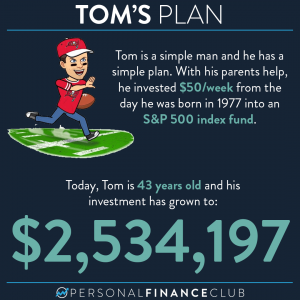

What do you do? Well, as much as we would all love to make clever financial moves to nimbly dance around these macroeconomic trends, that’s really not how you build wealth. With the benefit if hindsight, sometimes we see that we got slightly luckier timing, sometimes less lucky. But along the way we need to make solid decisions. Rent or buy less home. Save and invest more. The more intensely and consistently you do that over time, the more rich you get. That’s it. All the clever financial footwork becomes rounding error as time goes on.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy