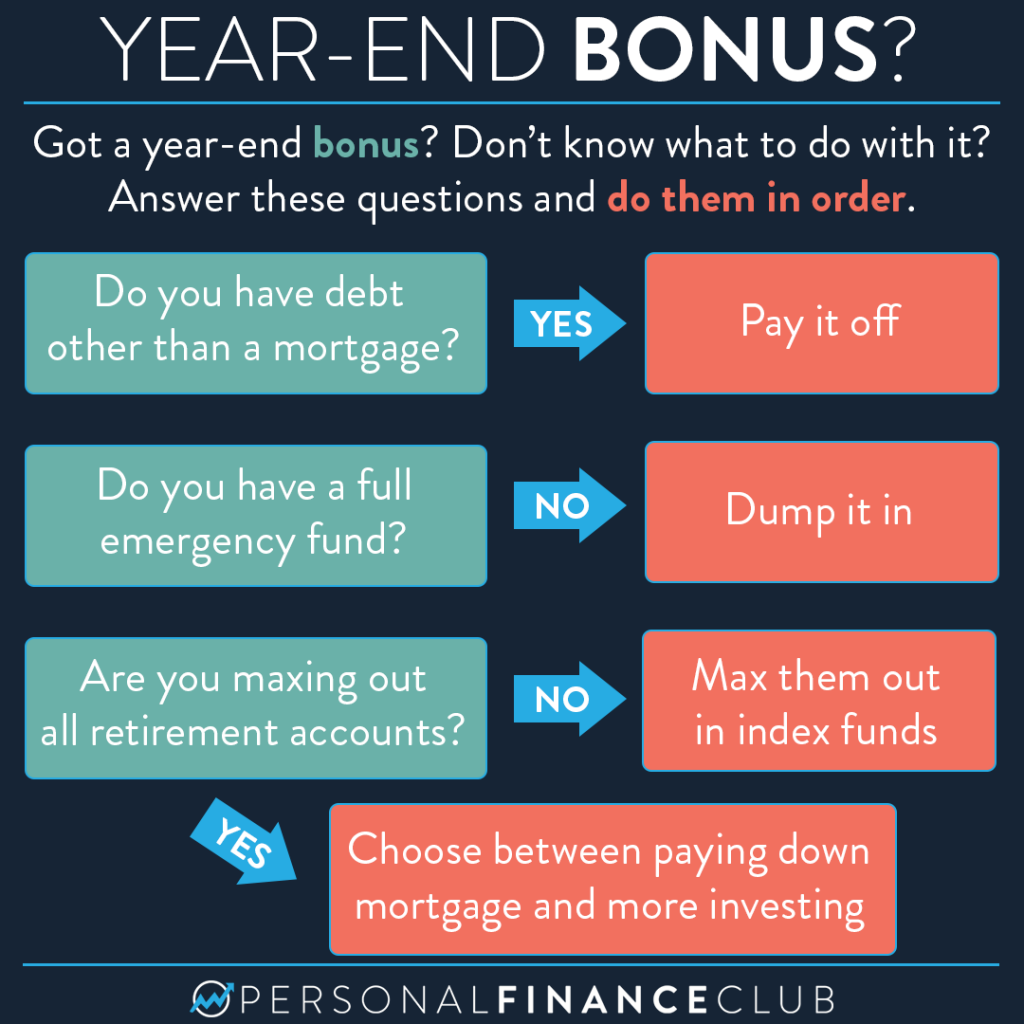

It’s the end of the year, and some lucky folks are getting year end bonuses! Or maybe you have come into some other infusion of cash, for example from selling your collectable set of miniature crystal violas to an anonymous wealthy collector in Myanmar (I hear about this situation all the time).

So when deciding where to put this money, I think focus is important. I wouldn’t work on more than one of these steps at a time. I most often see people feeling stuck when they’re doing a little of everything and not getting anywhere. Just go HAM on that debt. Forget about emergency funds and investing until you’re 100% debt free (except your mortgage). Then once those debt payments are freed up you can GO HAM on filling up your emergency fund. Once that’s done, then you can invest ALL those payments with no risk and all upside!

The final step is a little more nuanced. If you’re deciding between more investing and paying down a mortgage, it’s a judgment call. If you’re conservative and want the sure thing, go nuts on paying off the house (if you own one). If you’re comfortable with the mortgage payment, go ahead and invest more (buying index funds in a regular brokerage account or by buying investment real estate). They’re both good options. Neither is overly risky in my opinion. Do what feels right to you.

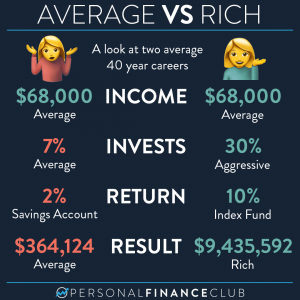

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram