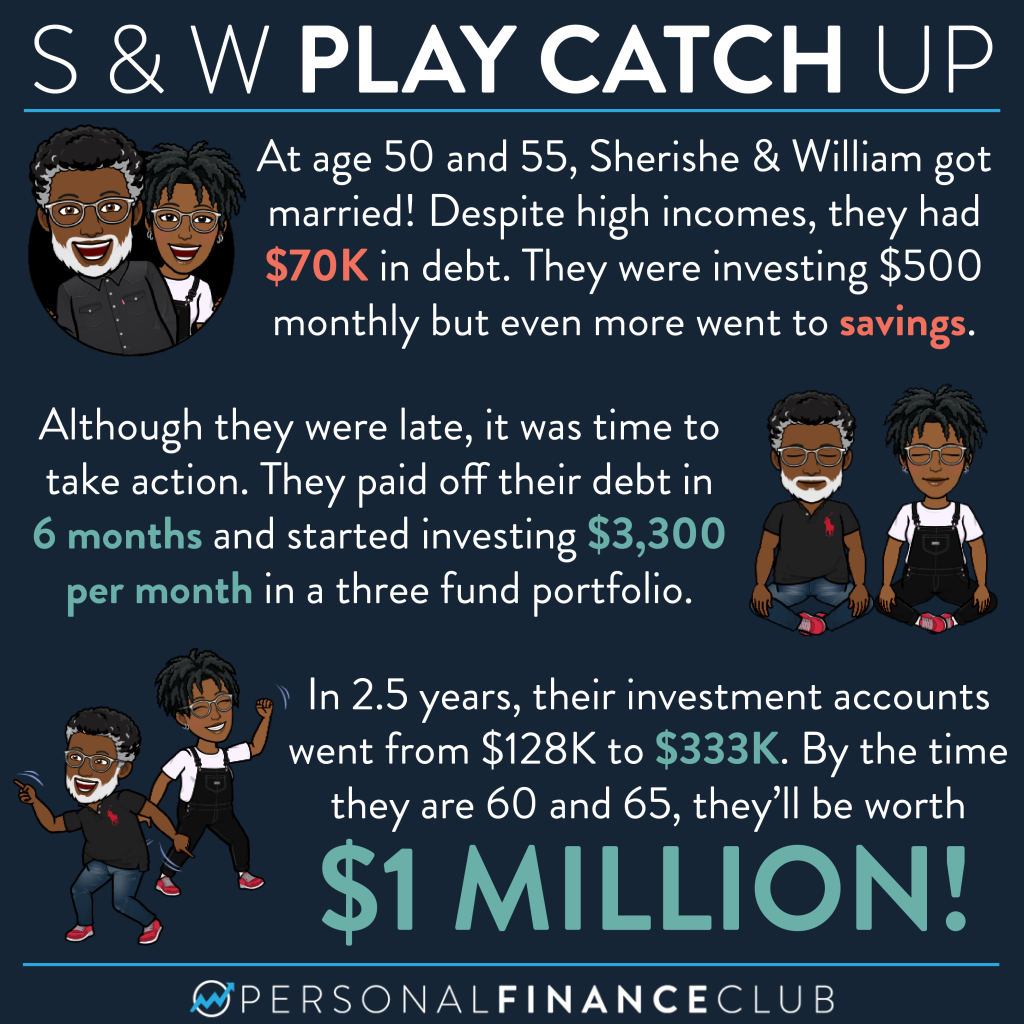

Meet Sherishe and William! It was not until 2 years ago, when they got married at ages 50 and 55, that they started their personal finance journey.

Before that, they didn’t have a plan for retirement and just assumed that things would work out.

At the time, Sherishe’s net worth was $200K. She had $128K in her investment accounts thanks to her 403b over the years, and William’s net worth was about $15K.

William is a retired law enforcement captain and fortunately has a pension that pays $66K/year, and Sherishe makes $112K/year as a midwife.

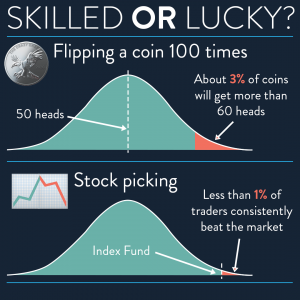

Despite a high income, they still had all sorts of debt – vehicles, credit cards, and student loans! They had $70K in non-mortgage debt and were investing $500/month. Their extra money was just going to a savings account… they knew nothing about index funds!

So they got it together by educating themselves and budgeting. They worked on paying off their debt ASAP. They opened up Roth IRAs and learned how to build a 3 fund portfolio!

Every month they invest $3,300. Sherishe maxes out her 403b at $26K/year and they both max out their Roth IRAs of $7K each. (The limits are higher because they are over 50)

Today their retirement accounts are worth $333K. At this rate, it will be worth $1M in 8 years! (After adjusting for inflation)

With William’s pension of $5,500/month and their social security that would pay around $1,700/month each at age 62, you must be wondering… that is MORE than enough, why even invest for retirement?!

Sherishe says, if anything happens to William or their social security, she still has her back covered. She is NOT relying on anyone! Now, they can be sure that they are set for life and even leave money for their kids. Even with his pension, William wishes he invested in retirement accounts earlier in life.

They are a living example that it’s NEVER TOO LATE! And even with a high income, it’s not what you make, it’s what you keep.

Have questions? Sherishe is doing a Q&A in her stories today over at @sherishelytton !

Reminding you of the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi

via Instagram

September Sale!

September Sale!