One of the most common questions I get is “should I invest in a permanent life insurance policy?” (or one of the many other names given to life insurance policies that carry a “cash value”). 100% of the time I am asked that question, it is coming from a young investor who has been recommended such a policy by someone who is selling them.

Unfortunately, anyone can call themself a “financial advisor”. That term on its own doesn’t mean anything or require any specific license. So it is extremely common for commissioned salespeople at insurance companies to use that title. When an unsuspecting new investor wants to start putting money away and seeks out a financial advisor, they often unknowingly end up in the office of an insurance salesperson. But as the post says, if your financial advisor is pushing any sort of insurance policy that carries a cash value, it’s time to seek a second opinion.

Let me be make a few more points:

• Some insurance salespeople are going to show up in the comments and beat me up over this. That’s ok, I can take it. But just remember, “It is difficult to get a man to understand something when his salary depends upon his not understanding it.” I’m not paid by the insurance industry.

• Not all insurance is bad. I carry auto, health, umbrella, and property insurance to name a few.

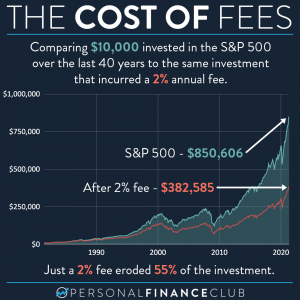

• These permanent life insurance policies come with big commission to the salesperson and will ultimately offer dramatically worse returns than the market can provide.

• Don’t fall for the many sales gimmicks including “tax free growth”, “be your own bank”, “no risk”, “just like an index fund”. That’s all so misleading I consider them flat out lies.

• I’ve read dozens of books on personal finance and investing. All of them recommend index funds. None recommend permanent life insurance.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!