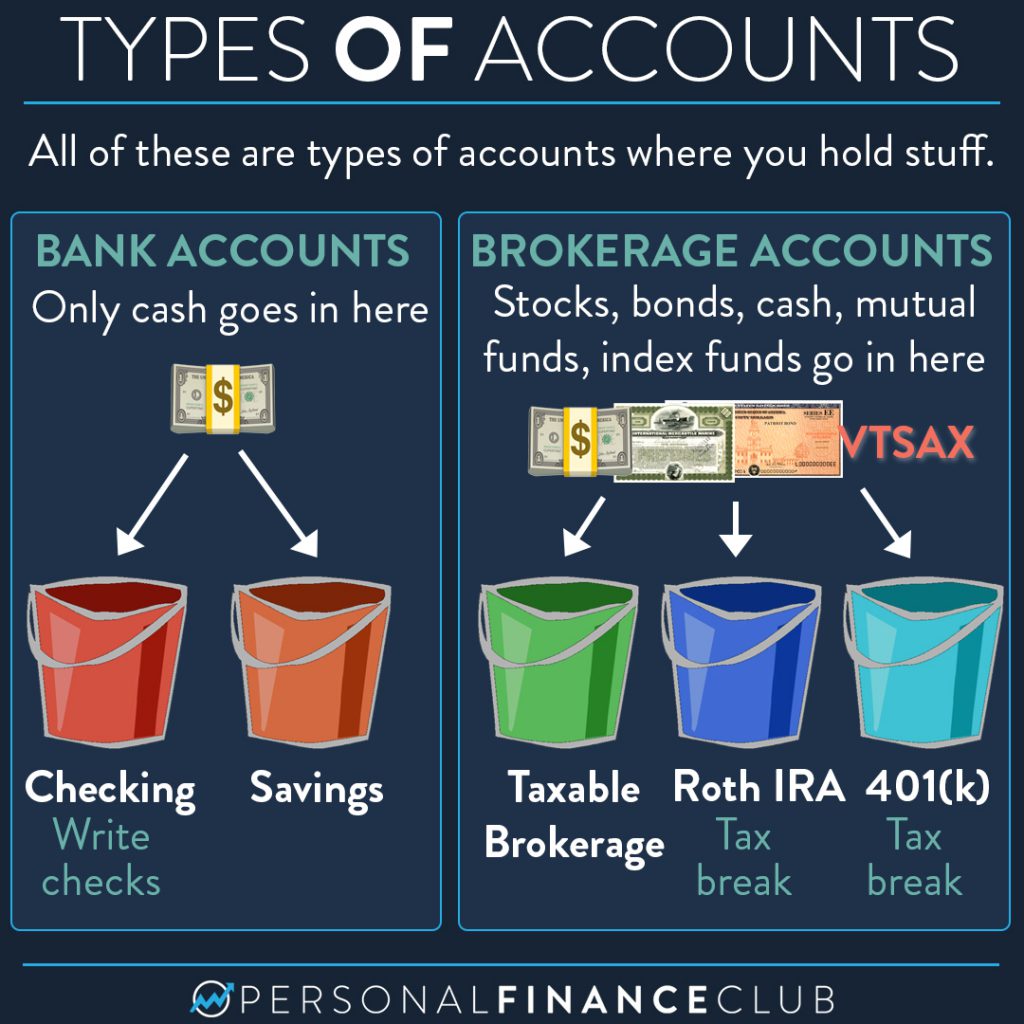

The most common confusion I see in investing is around the names of accounts. Roth IRA, 401(k), brokerage accounts, etc. They all sound so confusing! But here’s the thing. They’re all just weird names for plain old bank accounts. Just like checking and savings. They’re just empty buckets that hold stuff. But each one has a slightly different purpose or special rules. Let’s look at a few:

• Checking: You hold cash here. You can write checks from this type of account.

• Savings: You hold cash here. Generally provides interest on cash stored here. Historically more interest than a checking account.

• Brokerage account: You can hold cash here, but also stocks, bonds, mutual funds, index funds, etc. Instead of opening this type of account with a bank, you usually open it with a brokerage like Vanguard, Fidelity, Schwab or Betterment.

• Roth IRA: A special type of brokerage account. The same as above, but it also offers a tax break. Investments that grow in this type of account are never taxed again, but can’t be withdrawn until 59.5.

• 401(k), 403(b), TSP, 457: Special types of brokerage accounts. Can only be opened if your employer offer them. Also offer a tax break.

That’s really it. I know all the crazy words and numbers are intimidating, but they’re just accounts like checking or savings. Their crazy names generally come from the line of the tax code that allows for them, or the senator who proposed it (in the case of Roth!)

Also remember that alone, all of the above are just empty accounts. If you put cash in them, nothing special happens. So if you want to invest (in a Roth IRA for example), you have to contribute cash the account and then take a second stop to invest that money. If you don’t know what your Roth IRA is invested in, you may have made this mistake!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram