Anyone can use the title “financial advisor” with reckless indifference to the services they actually provide. Some insurance salesmen love this fact. Even though they are compensated either in part or entirely by selling life insurance, some unscrupulous insurance salespeople happily list “financial advisor” or the equivalent as their title.

This creates a confusing experience for many wealth builders seeking expert advice for the first time. They walk into the financial advisor’s office for the first time, and it’s not long before they’re receiving a sales pitch on various permanent life insurance products. The insurance salesmen can hardly be blamed. That’s their job. That’s how they and their business make money. They sell insurance. (Although, I do think many insurance salesmen CAN be blamed for the absolutely deceptive sales pitches they present)

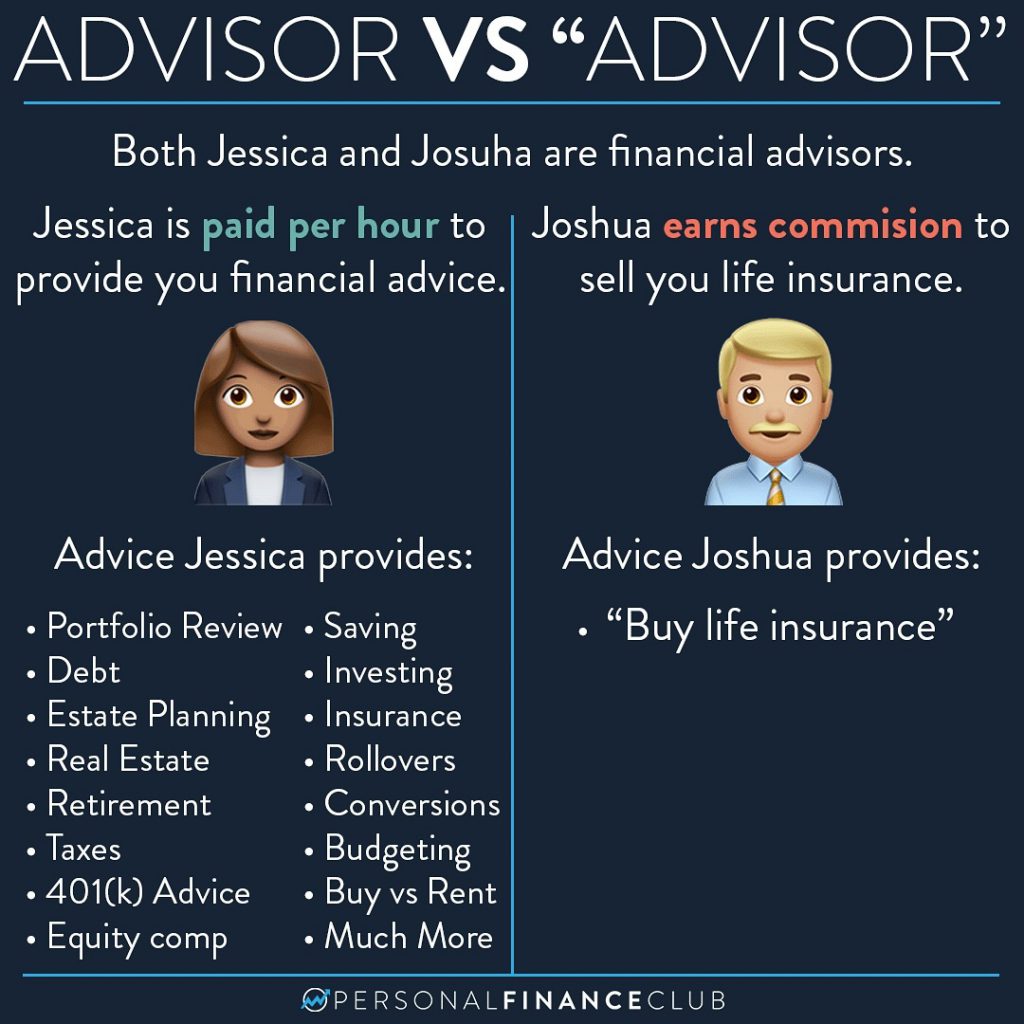

There’s actually a pretty simple solution to this problem. It’s called “advice-only” financial advisors. Advice-only advisors don’t sell any products, earn any commissions, or manage your money. They’re licensed fiduciaries and can advise on all topics money, they just don’t get paid based on what or whether you buy. Advice-only advisors are paid a flat rate per hour or per project.

If you’re not sure if your financial advisor is “advice-only”, ask them if you can pay for their advice with a credit card. Advice-only advisors will happily say “yes!”. Other advisors will give some other answer like “the planning services are free” or “we make money when you make money”. Those types of answers mean they are indeed getting paid on the back-end somewhere that likely causes a significant conflict of interest.

I’ve taken this approach for myself with Personal Finance Club. I don’t sell or have partnerships with any investment or insurance products. When I suggest what to buy or not buy, I might be wrong, but at least I’m not saying because I’m getting a kickback. That’s the minimum you should expect from your financial advisor.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy