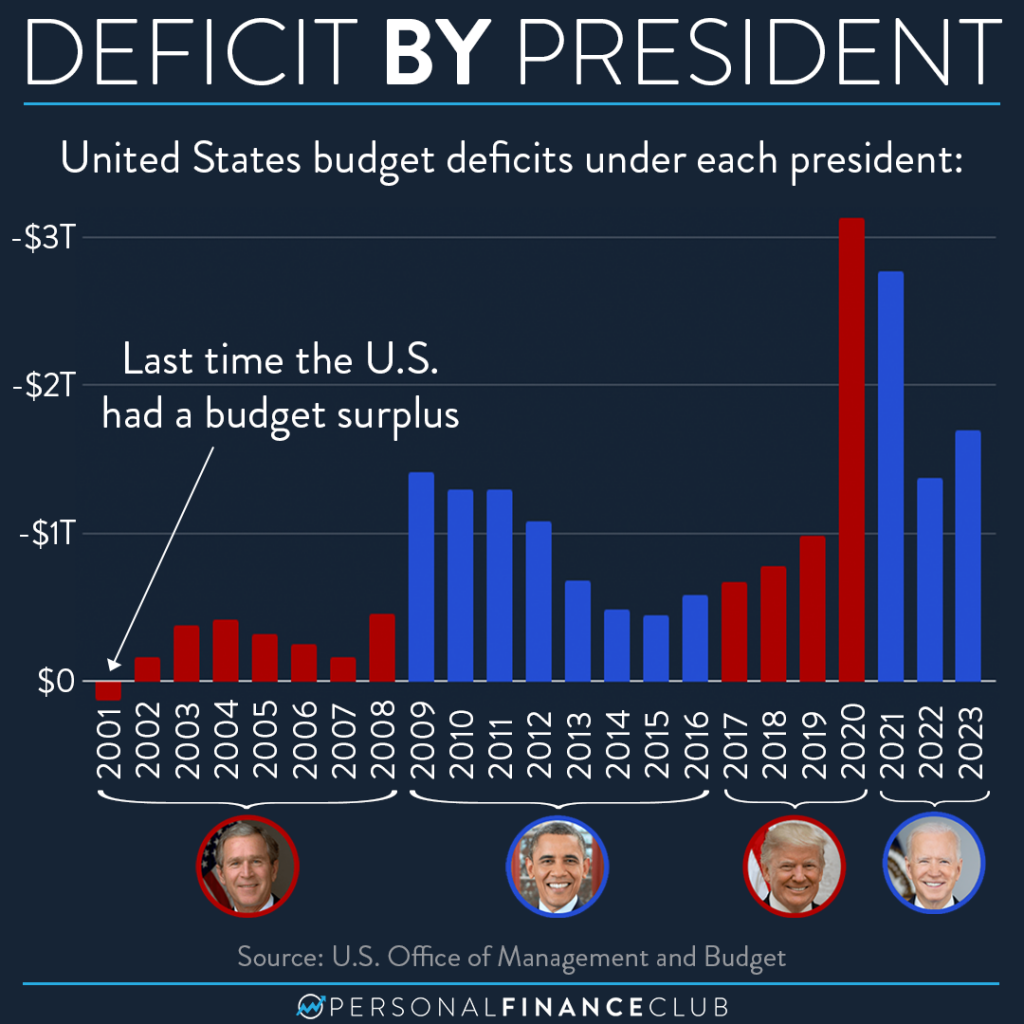

It doesn’t seem to matter who’s in office. We have run a budget deficit each of the last 22 years. And that streak doesn’t look like it’s about to end any time soon. Both political parties are guilty of spending more money than they bring in. This has resulted in the US racking up more than $34 trillion of national debt.

Is each president responsible for the deficit in the years listed? No, not fully. But it helps add some context to the chart. Things happen during a president’s term that is not in their control. For instance, Obama took office at the depths of the financial crisis, so there were large deficits afterwards as we tried to get our economy started again. Similarly, Trump was in office during the onset of Covid when a ton of government spending was needed.

How does the government survive if it continues to spend more than it makes?? By borrowing money! When the government sells bonds, they’re really just borrowing money to spend. Is it a sustainable path to keep spending much more than you bring in? No, definitely not.

The federal government is not setting a great example of “living below your means”. Whatever you do, the main takeaway is never spend like the US government. Always spend less than you make and invest the difference. If you consistently do this, you will be shocked what the magic of compound returns will do.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane