What is the best index fund? Comparing US total market and S&P 500 index funds

I often get asked, “what is the best index fund?” And the answer is “it doesn’t really matter.” There aren’t “good” or “bad” index funds.

I often get asked, “what is the best index fund?” And the answer is “it doesn’t really matter.” There aren’t “good” or “bad” index funds.

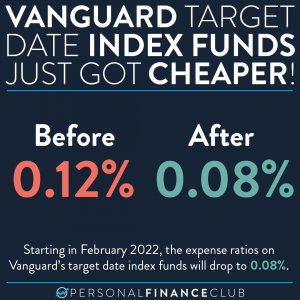

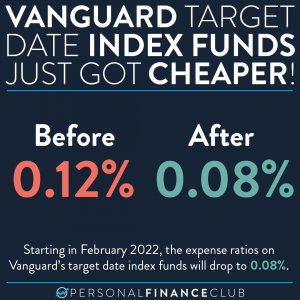

On December 29th, 2021 Vanguard Target Retirement Funds all dropped in share price by as much as 14% in a single day. In this article

It’s a wonderful time to be an investor in the US. Technology and competition has enabled brokerages to offer tons of zero transaction fee investments

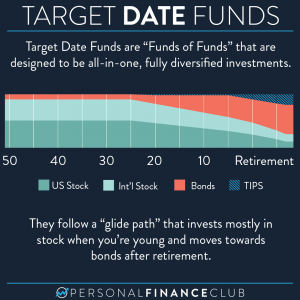

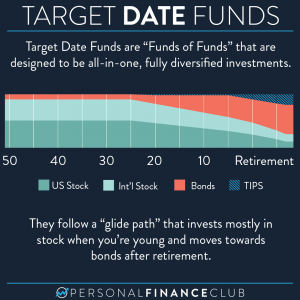

Those of you who have followed me for a while know that my FAVORITE way to invest is in a target date index fund! It’s

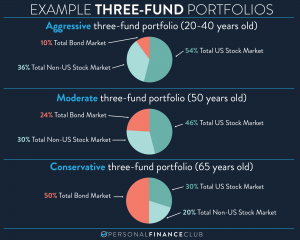

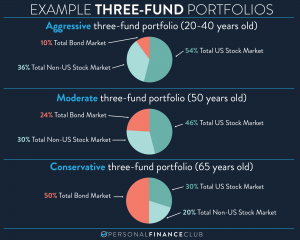

A three-fund portfolio is a simple way to diversify across the world’s stock and bond markets, and guarantee yourself your fair share of the full

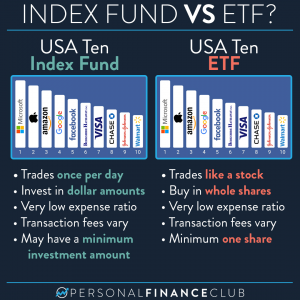

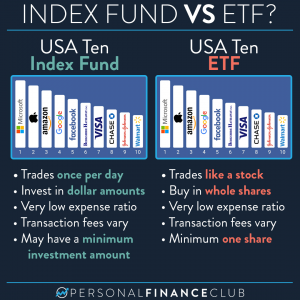

I get this question a lot. ETFs and index funds are nearly identical. The equivalent ETF and index fund (as the example above) contains the

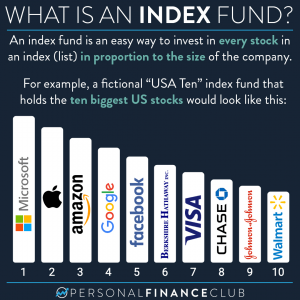

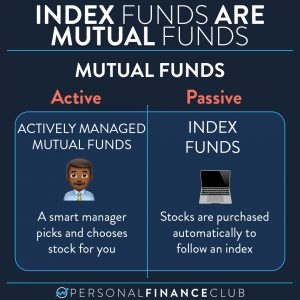

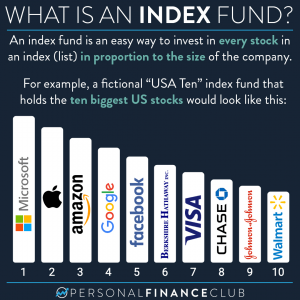

Learn the concept of an index fund and how it differs from an actively managed mutual fund.

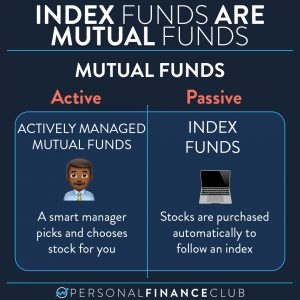

I talk a lot about index funds and sometimes I hear things like “I would never invest in a mutual fund.” While, I think the

Fidelity famously declared victory in the expense ratio wars last year when they released four zero fee index funds: FZROX: Fidelity® ZERO Total Market Index

I love target date index funds. I believe they’re your best bet to maximize long term wealth and almost every individual investor should put 100% of

I often get asked, “what is the best index fund?” And the answer is “it doesn’t really matter.” There aren’t “good” or “bad” index funds.

On December 29th, 2021 Vanguard Target Retirement Funds all dropped in share price by as much as 14% in a single day. In this article

It’s a wonderful time to be an investor in the US. Technology and competition has enabled brokerages to offer tons of zero transaction fee investments

Those of you who have followed me for a while know that my FAVORITE way to invest is in a target date index fund! It’s

A three-fund portfolio is a simple way to diversify across the world’s stock and bond markets, and guarantee yourself your fair share of the full

I get this question a lot. ETFs and index funds are nearly identical. The equivalent ETF and index fund (as the example above) contains the

Learn the concept of an index fund and how it differs from an actively managed mutual fund.

I talk a lot about index funds and sometimes I hear things like “I would never invest in a mutual fund.” While, I think the

Fidelity famously declared victory in the expense ratio wars last year when they released four zero fee index funds: FZROX: Fidelity® ZERO Total Market Index

I love target date index funds. I believe they’re your best bet to maximize long term wealth and almost every individual investor should put 100% of